CA - Worker Gets Benefits for Crash Despite Leaving Job Site Without Employer's Approval

04/25/2024 |

0

![]() A California appellate court upheld an award of benefits to a worker for his injuries from a car accident that happened after he left a fire camp without his employer’s knowledge and in violation of its rules, and used marijuana.

Braden Nanez worked for 3 Stonedeggs Inc., a mobile food service that contracts with the U.S. Forest Service to provide meals for firefighters and supporting personnel.

Nanez began working for the company in September 2020 at the age of 19. He was stationed at a fire camp in Brownsville and elected to stay on-site to get as many work hours as possible.

O...

Read More

A California appellate court upheld an award of benefits to a worker for his injuries from a car accident that happened after he left a fire camp without his employer’s knowledge and in violation of its rules, and used marijuana.

Braden Nanez worked for 3 Stonedeggs Inc., a mobile food service that contracts with the U.S. Forest Service to provide meals for firefighters and supporting personnel.

Nanez began working for the company in September 2020 at the age of 19. He was stationed at a fire camp in Brownsville and elected to stay on-site to get as many work hours as possible.

O...

Read More

NY - Court Revives Labor Law Claim of Worker Who Fell Into Manhole

04/25/2024 |

0

![]() A New York appellate court revived a worker’s Labor Law claim for injuries from falling into a manhole.

Case: Clarke v. Consolidated Edison of New York Inc., No. 158033/18, 04/18/2024, published.

Facts: Stephen Clarke suffered injuries when he fell into a manhole while he was working for his employer, which had contracted with Consolidated Edison of New York Inc. to perform underground inspections and repairs of network distribution equipment.

Procedural history: Clarke filed suit against Con Ed, asserting a claim for violations of the Labor Law.

Con Ed moved for summary judgmen...

Read More

A New York appellate court revived a worker’s Labor Law claim for injuries from falling into a manhole.

Case: Clarke v. Consolidated Edison of New York Inc., No. 158033/18, 04/18/2024, published.

Facts: Stephen Clarke suffered injuries when he fell into a manhole while he was working for his employer, which had contracted with Consolidated Edison of New York Inc. to perform underground inspections and repairs of network distribution equipment.

Procedural history: Clarke filed suit against Con Ed, asserting a claim for violations of the Labor Law.

Con Ed moved for summary judgmen...

Read More

CT - Notice of Intent to Contest Claim Must Be Delivered Within 28-Day Window

04/25/2024 |

0

![]() The Connecticut Supreme Court upheld a finding that an employer was precluded from contesting a worker’s claims for injury because the company did not timely file a notice of intent to do so.

Case: Ajdini v. Frank Lill & Son Inc., No. SC 20836, 04/23/2024, published.

Facts and procedural history: Ajredin Ajdini worked for Frank Lill & Son Inc. He allegedly sustained two injuries at work in July 2018. Ajdini filed separate claim forms that were received by the Workers’ Compensation Commission and FL&S on May 3, 2019.

FL&S mailed to the commission and Ajdini n...

Read More

The Connecticut Supreme Court upheld a finding that an employer was precluded from contesting a worker’s claims for injury because the company did not timely file a notice of intent to do so.

Case: Ajdini v. Frank Lill & Son Inc., No. SC 20836, 04/23/2024, published.

Facts and procedural history: Ajredin Ajdini worked for Frank Lill & Son Inc. He allegedly sustained two injuries at work in July 2018. Ajdini filed separate claim forms that were received by the Workers’ Compensation Commission and FL&S on May 3, 2019.

FL&S mailed to the commission and Ajdini n...

Read More

WV - Split Supreme Court Addresses Standard of Review, Burden of Proof for Apportionment

04/25/2024 |

0

![]() A divided West Virginia Supreme Court produced four opinions addressing an employer’s entitlement to apportion a worker’s impairment, with a majority clarifying the appropriate standard of review of a board decision and then concluding that the employer failed to carry its burden of proof on apportionment.

Case: Duff v. Kanawha County Commission, No. 23-43, 04/22/2024, published.

Facts: David Duff II worked for Kanawha County as a deputy sheriff. He injured his back in June 202 while lifting a bomb detector robot.

A claims adjuster for the county’s insurance carrier accept...

Read More

A divided West Virginia Supreme Court produced four opinions addressing an employer’s entitlement to apportion a worker’s impairment, with a majority clarifying the appropriate standard of review of a board decision and then concluding that the employer failed to carry its burden of proof on apportionment.

Case: Duff v. Kanawha County Commission, No. 23-43, 04/22/2024, published.

Facts: David Duff II worked for Kanawha County as a deputy sheriff. He injured his back in June 202 while lifting a bomb detector robot.

A claims adjuster for the county’s insurance carrier accept...

Read More

Sponsored Content

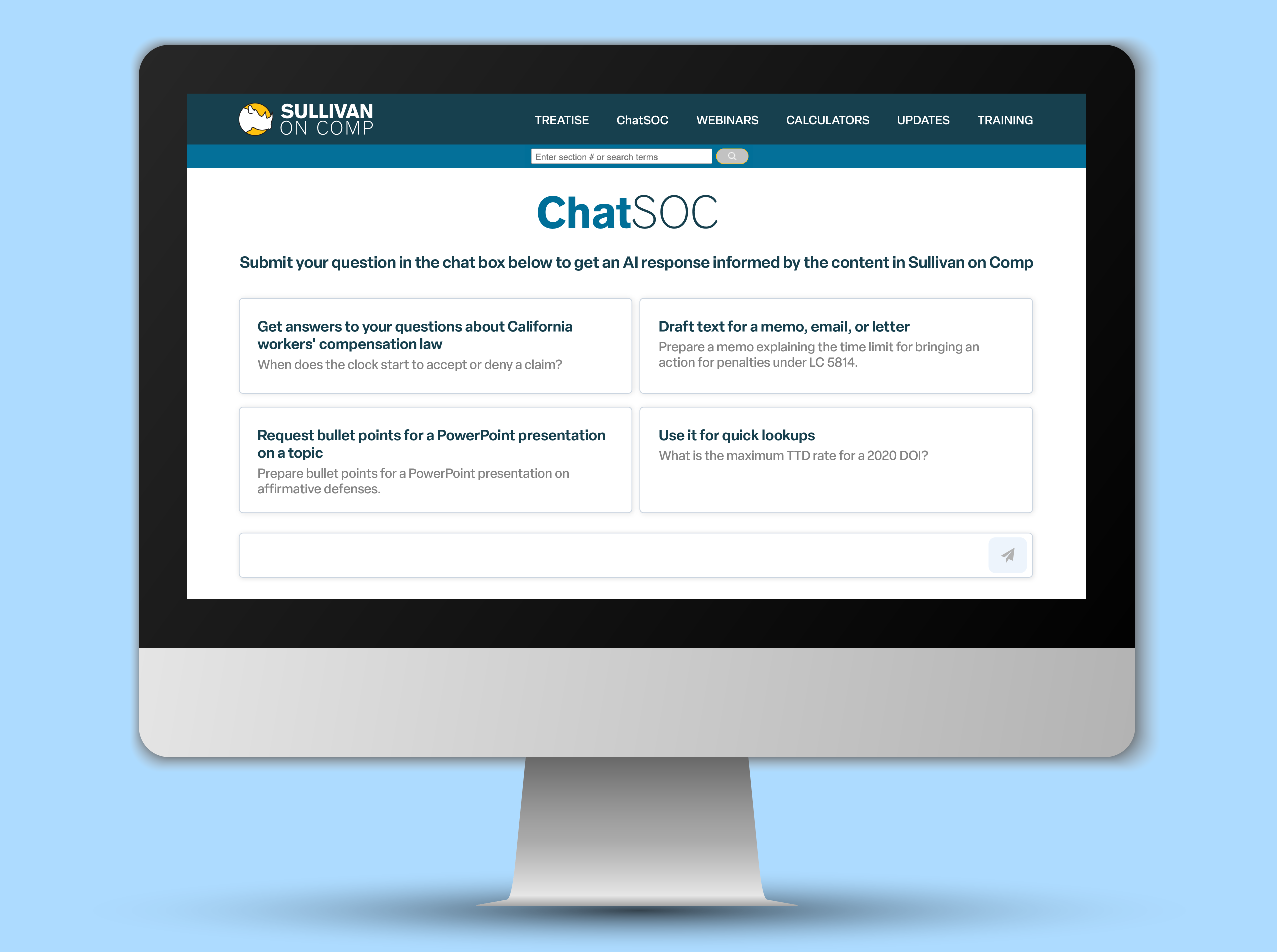

Press - Sullivan on Comp Launches ChatSOC, an Innovative Chatbot for California Workers' Compensation Professionals, Integrated with Authoritative Legal Treatise

04/22/2024 |

0

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

Post Your Press Release Here!

Industry Insights

FL - Langham: Uniformity in Regulations

By Judge David Langham

04/25/2024 |

0

![]() On April 11, Gov. Ron DeSantis signed CS/CS/HB 433. That designation, as we have noted previously, has meaning.

The "CS" reflects that the bill that was signed is not the same as the one that was introduced in the House of Representatives. The "CS" stands for "committee substitute," and since this bill has that twice in the name, there is evidence of significant effort and alteration between filing and passage. What eventually passed was the second committee substitute.

The "HB" is noteworthy also. That tells the reader that the bill originate...

Read More

On April 11, Gov. Ron DeSantis signed CS/CS/HB 433. That designation, as we have noted previously, has meaning.

The "CS" reflects that the bill that was signed is not the same as the one that was introduced in the House of Representatives. The "CS" stands for "committee substitute," and since this bill has that twice in the name, there is evidence of significant effort and alteration between filing and passage. What eventually passed was the second committee substitute.

The "HB" is noteworthy also. That tells the reader that the bill originate...

Read More

CA - Newsom Says Indoor Heat Safety Rules Too Expensive for Prisons

04/25/2024 |

0

![]() Correctional officers and other workers are likely to be left out of the new indoor heat standards California workplace safety regulators are reportedly scrambling to implement before summer starts after a last-minute objection from the governor's office over the cost of bringing prisons into compliance derailed the rulemaking process.

The California Division of Occupational Safety and Health in May 2023 started the formal process to adopt heat standards for indoor workplaces that have been in the works since 2016, according to reports by PBS and CalMatters.

California has had heat stand...

Read More

Correctional officers and other workers are likely to be left out of the new indoor heat standards California workplace safety regulators are reportedly scrambling to implement before summer starts after a last-minute objection from the governor's office over the cost of bringing prisons into compliance derailed the rulemaking process.

The California Division of Occupational Safety and Health in May 2023 started the formal process to adopt heat standards for indoor workplaces that have been in the works since 2016, according to reports by PBS and CalMatters.

California has had heat stand...

Read More

FL - Contractors Cited After Worker's Crane Death

FL - Contractors Cited After Worker's Crane Death

04/25/2024 |

0

![]() The U.S. Occupational Safety and Health Administration on Tuesday said it cited two Florida construction contractors over an October 2023 workplace death.

OSHA cited Tampa-based Concrete Impressions of Florida Inc. and Plant City-based Adcock Cranes, proposing penalties of $4,839 and $16,131, respectively, following the death of a worker who was struck by a boom as a crane tipped over during work on an Orlando highway ramp.

Employees of both companies were installing precast concrete sound barrier panels on the SR 417 ramp at the time of the incident.

A Concrete Impressions employee wa...

Read More

The U.S. Occupational Safety and Health Administration on Tuesday said it cited two Florida construction contractors over an October 2023 workplace death.

OSHA cited Tampa-based Concrete Impressions of Florida Inc. and Plant City-based Adcock Cranes, proposing penalties of $4,839 and $16,131, respectively, following the death of a worker who was struck by a boom as a crane tipped over during work on an Orlando highway ramp.

Employees of both companies were installing precast concrete sound barrier panels on the SR 417 ramp at the time of the incident.

A Concrete Impressions employee wa...

Read More

CO - Senate Passes Bill Prohibiting State From Forcing Workers to Quit as Settlement Condition

04/25/2024 |

0

![]() The Colorado Senate passed a bill that would prohibit the state from forcing its injured workers to quit as a condition of settling workers’ compensation claims.

The Senate on Wednesday voted 22-8 to pass SB 149, by Sen. Nick Hinrichsen, D-Pueblo.

The bill would prohibit the state from suggesting or requiring that a state employee resign when settling a workers’ compensation claim. It would also prohibit settlement conditions that require a worker to agree to never seek employment from the state in the future.

The bill was amended before Wednesday’s vote to revise language...

Read More

The Colorado Senate passed a bill that would prohibit the state from forcing its injured workers to quit as a condition of settling workers’ compensation claims.

The Senate on Wednesday voted 22-8 to pass SB 149, by Sen. Nick Hinrichsen, D-Pueblo.

The bill would prohibit the state from suggesting or requiring that a state employee resign when settling a workers’ compensation claim. It would also prohibit settlement conditions that require a worker to agree to never seek employment from the state in the future.

The bill was amended before Wednesday’s vote to revise language...

Read More

OK - Governor Signs Bill Allowing Electronic Cancellation Notices

04/25/2024 |

0

Insurers will be allowed to send electronic cancellation notices to Oklahoma policyholders, under terms of a bill Gov. Kevin Stitt signed Wednesday.

Stitt signed SB 1627, by Sen. Ally Seifried, R-Claremore, which allows electronic cancellation notices if recipients have consented to receive notices electronically and the carrier complies with the Uniform Electronic Transactions Act.

SB 1627 says electronic cancellation notices have the same effect as those sent by mail.

The state House of Representatives voted 90-0 to pass the bill on April 17. The Senate voted 44-3 to pass it on Feb. 29.

...

Read More

Sponsored Content

Press - Centre for Neuro Skills Study Finds Differences in Sleep Patterns Between Men and Women with Post-Traumatic Brain Injury

03/05/2024 |

0

Centre for Neuro Skills Study Finds Differences in Sleep Patterns

Between Men and Women with Post-Traumatic Brain Injury

Incidental finding indicates Melatonin helps post-acute TBI patients achieve longer REM sleep

Bakersfield, Calif. (Mar. 5) � Centre for Neuro Skills?(CNS), a premier provider of traumatic and acquired brain injury rehabilitation services, has shared findings from a study researching sleep-wake disturbances, published in Neurotrauma Reports on January 3, 2024. They found that sleep deficits are correlated with poorer brain injury patient outcomes (verbal ...

Read More

Post Your Press Release Here!

CA - DWC Launches Portal for QME Reports

04/24/2024 |

3

![]() The California Division of Workers’ Compensation on Tuesday announced the launch of a portal that it said it will use to monitor the quality of medical-legal reports.

Earlier this year, the division adopted new rules governing the medical-legal process to address deficiencies pointed out in a 2019 report by the State Auditor.

The rules, which have been in effect since Feb. 26, reduced the number of education hours needed for chiropractors to quality as QMEs, to 25 from 44, to “remove an outdated barrier to physicians coming into the QME program.”

Additionally, the rul...

Read More

The California Division of Workers’ Compensation on Tuesday announced the launch of a portal that it said it will use to monitor the quality of medical-legal reports.

Earlier this year, the division adopted new rules governing the medical-legal process to address deficiencies pointed out in a 2019 report by the State Auditor.

The rules, which have been in effect since Feb. 26, reduced the number of education hours needed for chiropractors to quality as QMEs, to 25 from 44, to “remove an outdated barrier to physicians coming into the QME program.”

Additionally, the rul...

Read More

IL - Worker Not Entitled to Additional Benefits, Compensation for Other Alleged Injuries

04/24/2024 |

0

![]() The Illinois Appellate Court upheld a determination that a school district employee was not entitled to additional benefits for alleged injuries to his hips and knees after he hurt his ankle in a workplace fall.

Case: Osman v. IWCC (East Aurora School District 131), No. 2-23-0180WC, 04/15/2024, published.

Facts: Scott Osman worked for East Aurora School District 131. He suffered an injury to his right ankle in January 2020 when he fell from a ladder at work.

Osman underwent surgery and missed about 26 weeks of work before his doctor opined that he was at maximum medical improvement in May 2...

Read More

The Illinois Appellate Court upheld a determination that a school district employee was not entitled to additional benefits for alleged injuries to his hips and knees after he hurt his ankle in a workplace fall.

Case: Osman v. IWCC (East Aurora School District 131), No. 2-23-0180WC, 04/15/2024, published.

Facts: Scott Osman worked for East Aurora School District 131. He suffered an injury to his right ankle in January 2020 when he fell from a ladder at work.

Osman underwent surgery and missed about 26 weeks of work before his doctor opined that he was at maximum medical improvement in May 2...

Read More

LA - Worker Gets Benefits for Foot Injury, Remains Entitled Despite Rejecting Job Offer

04/24/2024 |

0

![]() A Louisiana appellate court ruled that a worker suffered a compensable injury to her foot when a patient ran over it in a wheelchair and that she was entitled to supplemental earnings benefits after she rejected a modified job offered by her employer.

Case: Guillory v. St. Michael PFU LLC, Nos. 23-674 and 23-675, 04/17/2024, published.

Facts: Temika Williams Guillory worked as a van driver for St. Michael PFU LLC. While she was at work on May 11, 2018, a patient in a bariatric wheelchair allegedly rolled over Guillory’s right foot.

Guillory testified that her foot hurt immediately fol...

Read More

A Louisiana appellate court ruled that a worker suffered a compensable injury to her foot when a patient ran over it in a wheelchair and that she was entitled to supplemental earnings benefits after she rejected a modified job offered by her employer.

Case: Guillory v. St. Michael PFU LLC, Nos. 23-674 and 23-675, 04/17/2024, published.

Facts: Temika Williams Guillory worked as a van driver for St. Michael PFU LLC. While she was at work on May 11, 2018, a patient in a bariatric wheelchair allegedly rolled over Guillory’s right foot.

Guillory testified that her foot hurt immediately fol...

Read More

NY - Worker Struck by Falling Objects Gets Summary Judgment on Labor Law Claim

04/24/2024 |

0

![]() A New York appellate court upheld summary judgment to a worker on his Labor Law claim for injuries from being struck by falling objects.

Case: Bartley v. 76 Eleventh Avenue Property Owner LLC, No. 157312/19, 04/18/2024, published.

Facts: Phillip Bartley allegedly suffered injuries while stripping wooden forms from overhead concrete beams as part of the construction of a tower.

Bartley said the forms were supported by jacks, which were placed every few feet. He claimed that while he was underneath the forms stabilizing a loosened jack, the beam, ribs and another jack fell onto his ...

Read More

A New York appellate court upheld summary judgment to a worker on his Labor Law claim for injuries from being struck by falling objects.

Case: Bartley v. 76 Eleventh Avenue Property Owner LLC, No. 157312/19, 04/18/2024, published.

Facts: Phillip Bartley allegedly suffered injuries while stripping wooden forms from overhead concrete beams as part of the construction of a tower.

Bartley said the forms were supported by jacks, which were placed every few feet. He claimed that while he was underneath the forms stabilizing a loosened jack, the beam, ribs and another jack fell onto his ...

Read More

NY - Court Upholds Partial Dismissal of Worker's Trip-and-Fall Claim

04/24/2024 |

0

![]() A New York appellate court upheld a grant of partial summary judgment dismissing a worker’s Labor Law claim for trip-and-fall injury at a construction site.

Case: Brown v. Tishman Construction Corp., No. 154484/19, 04/18/2024, published.

Facts: William Brown suffered injuries while working on a construction project at a property owned by BOP NE LLC. Tishman Construction Corp. was the general contractor for the project.

According to Brown, one of his co-workers was preparing a wall for concrete pouring by "stuffing" it with rebar. Brown claimed he was attempting to step ...

Read More

A New York appellate court upheld a grant of partial summary judgment dismissing a worker’s Labor Law claim for trip-and-fall injury at a construction site.

Case: Brown v. Tishman Construction Corp., No. 154484/19, 04/18/2024, published.

Facts: William Brown suffered injuries while working on a construction project at a property owned by BOP NE LLC. Tishman Construction Corp. was the general contractor for the project.

According to Brown, one of his co-workers was preparing a wall for concrete pouring by "stuffing" it with rebar. Brown claimed he was attempting to step ...

Read More

CA - Appropriations Committee Places TD Bills on Suspense File

04/24/2024 |

0

![]() The California Senate Appropriations Committee put a temporary hold on two bills that would authorize temporary disability benefits for attending medical appointments and for successfully challenging the denial of a request for authorization.

The committee on Monday unanimously sent SB 1205 and SB 1346 to its suspense file. The Senate Appropriations Committee typically refers to its suspense file bills that are projected to cost the general fund $50,000 or more, as well as bills projected to cost special funds, such as the Workers’ Compensation Administration Revolving Fund, $150,000 or...

Read More

The California Senate Appropriations Committee put a temporary hold on two bills that would authorize temporary disability benefits for attending medical appointments and for successfully challenging the denial of a request for authorization.

The committee on Monday unanimously sent SB 1205 and SB 1346 to its suspense file. The Senate Appropriations Committee typically refers to its suspense file bills that are projected to cost the general fund $50,000 or more, as well as bills projected to cost special funds, such as the Workers’ Compensation Administration Revolving Fund, $150,000 or...

Read More

NATL. - WCRI Study Tracks Rapid Comp Indemnity Growth Post-Pandemic

NATL. - WCRI Study Tracks Rapid Comp Indemnity Growth Post-Pandemic

04/24/2024 |

0

![]() Indemnity benefits per claim grew at a “rapid” pace of 6% or more in 2022 in 16 out of 17 states analyzed by the Workers Compensation Research Institute, which said data before 2021 showed little change.

WCRI said the tight labor market led to wage growth across the board and increased the duration of temporary disability, which reflected “a growing share of new hires in the workforce and changes in comorbidities since the COVID-19 pandemic,” according to a statement on 14 research reports published Tuesday.

As highlighted by WCRI, Florida, Illinois, Michigan, Te...

Read More

Indemnity benefits per claim grew at a “rapid” pace of 6% or more in 2022 in 16 out of 17 states analyzed by the Workers Compensation Research Institute, which said data before 2021 showed little change.

WCRI said the tight labor market led to wage growth across the board and increased the duration of temporary disability, which reflected “a growing share of new hires in the workforce and changes in comorbidities since the COVID-19 pandemic,” according to a statement on 14 research reports published Tuesday.

As highlighted by WCRI, Florida, Illinois, Michigan, Te...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More