CA - DWC Launches Portal for QME Reports

04/24/2024 |

2

![]() The California Division of Workers’ Compensation on Tuesday announced the launch of a portal that it said it will use to monitor the quality of medical-legal reports.

Earlier this year, the division adopted new rules governing the medical-legal process to address deficiencies pointed out in a 2019 report by the State Auditor.

The rules, which have been in effect since Feb. 26, reduced the number of education hours needed for chiropractors to quality as QMEs, to 25 from 44, to “remove an outdated barrier to physicians coming into the QME program.”

Additionally, the rul...

Read More

The California Division of Workers’ Compensation on Tuesday announced the launch of a portal that it said it will use to monitor the quality of medical-legal reports.

Earlier this year, the division adopted new rules governing the medical-legal process to address deficiencies pointed out in a 2019 report by the State Auditor.

The rules, which have been in effect since Feb. 26, reduced the number of education hours needed for chiropractors to quality as QMEs, to 25 from 44, to “remove an outdated barrier to physicians coming into the QME program.”

Additionally, the rul...

Read More

IL - Worker Not Entitled to Additional Benefits, Compensation for Other Alleged Injuries

04/24/2024 |

0

![]() The Illinois Appellate Court upheld a determination that a school district employee was not entitled to additional benefits for alleged injuries to his hips and knees after he hurt his ankle in a workplace fall.

Case: Osman v. IWCC (East Aurora School District 131), No. 2-23-0180WC, 04/15/2024, published.

Facts: Scott Osman worked for East Aurora School District 131. He suffered an injury to his right ankle in January 2020 when he fell from a ladder at work.

Osman underwent surgery and missed about 26 weeks of work before his doctor opined that he was at maximum medical improvement in May 2...

Read More

The Illinois Appellate Court upheld a determination that a school district employee was not entitled to additional benefits for alleged injuries to his hips and knees after he hurt his ankle in a workplace fall.

Case: Osman v. IWCC (East Aurora School District 131), No. 2-23-0180WC, 04/15/2024, published.

Facts: Scott Osman worked for East Aurora School District 131. He suffered an injury to his right ankle in January 2020 when he fell from a ladder at work.

Osman underwent surgery and missed about 26 weeks of work before his doctor opined that he was at maximum medical improvement in May 2...

Read More

LA - Worker Gets Benefits for Foot Injury, Remains Entitled Despite Rejecting Job Offer

04/24/2024 |

0

![]() A Louisiana appellate court ruled that a worker suffered a compensable injury to her foot when a patient ran over it in a wheelchair and that she was entitled to supplemental earnings benefits after she rejected a modified job offered by her employer.

Case: Guillory v. St. Michael PFU LLC, Nos. 23-674 and 23-675, 04/17/2024, published.

Facts: Temika Williams Guillory worked as a van driver for St. Michael PFU LLC. While she was at work on May 11, 2018, a patient in a bariatric wheelchair allegedly rolled over Guillory’s right foot.

Guillory testified that her foot hurt immediately fol...

Read More

A Louisiana appellate court ruled that a worker suffered a compensable injury to her foot when a patient ran over it in a wheelchair and that she was entitled to supplemental earnings benefits after she rejected a modified job offered by her employer.

Case: Guillory v. St. Michael PFU LLC, Nos. 23-674 and 23-675, 04/17/2024, published.

Facts: Temika Williams Guillory worked as a van driver for St. Michael PFU LLC. While she was at work on May 11, 2018, a patient in a bariatric wheelchair allegedly rolled over Guillory’s right foot.

Guillory testified that her foot hurt immediately fol...

Read More

NY - Worker Struck by Falling Objects Gets Summary Judgment on Labor Law Claim

04/24/2024 |

0

![]() A New York appellate court upheld summary judgment to a worker on his Labor Law claim for injuries from being struck by falling objects.

Case: Bartley v. 76 Eleventh Avenue Property Owner LLC, No. 157312/19, 04/18/2024, published.

Facts: Phillip Bartley allegedly suffered injuries while stripping wooden forms from overhead concrete beams as part of the construction of a tower.

Bartley said the forms were supported by jacks, which were placed every few feet. He claimed that while he was underneath the forms stabilizing a loosened jack, the beam, ribs and another jack fell onto his ...

Read More

A New York appellate court upheld summary judgment to a worker on his Labor Law claim for injuries from being struck by falling objects.

Case: Bartley v. 76 Eleventh Avenue Property Owner LLC, No. 157312/19, 04/18/2024, published.

Facts: Phillip Bartley allegedly suffered injuries while stripping wooden forms from overhead concrete beams as part of the construction of a tower.

Bartley said the forms were supported by jacks, which were placed every few feet. He claimed that while he was underneath the forms stabilizing a loosened jack, the beam, ribs and another jack fell onto his ...

Read More

Sponsored Content

Press - Centre for Neuro Skills Promotes Dallas-based Dr. Stefanie Howell to Director of Research Integration

03/12/2024 |

0

Centre for Neuro Skills Promotes Dallas-based Dr. Stefanie Howell to Director of Research Integration

Bakersfield, Calif. (March 12, 2024) � Centre for Neuro Skills (CNS), a leader in traumatic brain injury and stroke rehabilitation services, today announced the promotion of Stefanie N. Howell, Ph.D., CBIS, to director of research integration.

�Stefanie has been integral to Centre for Neuro Skills� research program, looking closely at how we can not only improve the lives of our patients but people with brain injuries everywhere,� said David Harrington, president and CEO of Centre fo...

Read More

Post Your Press Release Here!

Industry Insights

CA - Kamin: Expanding the Good-Faith Personnel Action Defense

By John P. Kamin

04/24/2024 |

0

![]() Defendants can use a successful good-faith personnel action defense to fight compensability of body parts that emanated from an alleged psychological injury, thanks to a 2012 published decision from the 4th District Court of Appeal.

Twelve years after a California appellate court issued its decision in County of San Bernardino v. WCAB (McCoy), it remains good law today. The case stands for the proposition that the good-faith personnel action defense can apply to more than just psych injuries when the following circumstances occur:

The applicant has suffere...

Read More

Defendants can use a successful good-faith personnel action defense to fight compensability of body parts that emanated from an alleged psychological injury, thanks to a 2012 published decision from the 4th District Court of Appeal.

Twelve years after a California appellate court issued its decision in County of San Bernardino v. WCAB (McCoy), it remains good law today. The case stands for the proposition that the good-faith personnel action defense can apply to more than just psych injuries when the following circumstances occur:

The applicant has suffere...

Read More

NY - Court Upholds Partial Dismissal of Worker's Trip-and-Fall Claim

04/24/2024 |

0

![]() A New York appellate court upheld a grant of partial summary judgment dismissing a worker’s Labor Law claim for trip-and-fall injury at a construction site.

Case: Brown v. Tishman Construction Corp., No. 154484/19, 04/18/2024, published.

Facts: William Brown suffered injuries while working on a construction project at a property owned by BOP NE LLC. Tishman Construction Corp. was the general contractor for the project.

According to Brown, one of his co-workers was preparing a wall for concrete pouring by "stuffing" it with rebar. Brown claimed he was attempting to step ...

Read More

A New York appellate court upheld a grant of partial summary judgment dismissing a worker’s Labor Law claim for trip-and-fall injury at a construction site.

Case: Brown v. Tishman Construction Corp., No. 154484/19, 04/18/2024, published.

Facts: William Brown suffered injuries while working on a construction project at a property owned by BOP NE LLC. Tishman Construction Corp. was the general contractor for the project.

According to Brown, one of his co-workers was preparing a wall for concrete pouring by "stuffing" it with rebar. Brown claimed he was attempting to step ...

Read More

CA - Appropriations Committee Places TD Bills on Suspense File

04/24/2024 |

0

![]() The California Senate Appropriations Committee put a temporary hold on two bills that would authorize temporary disability benefits for attending medical appointments and for successfully challenging the denial of a request for authorization.

The committee on Monday unanimously sent SB 1205 and SB 1346 to its suspense file. The Senate Appropriations Committee typically refers to its suspense file bills that are projected to cost the general fund $50,000 or more, as well as bills projected to cost special funds, such as the Workers’ Compensation Administration Revolving Fund, $150,000 or...

Read More

The California Senate Appropriations Committee put a temporary hold on two bills that would authorize temporary disability benefits for attending medical appointments and for successfully challenging the denial of a request for authorization.

The committee on Monday unanimously sent SB 1205 and SB 1346 to its suspense file. The Senate Appropriations Committee typically refers to its suspense file bills that are projected to cost the general fund $50,000 or more, as well as bills projected to cost special funds, such as the Workers’ Compensation Administration Revolving Fund, $150,000 or...

Read More

NATL. - WCRI Study Tracks Rapid Comp Indemnity Growth Post-Pandemic

NATL. - WCRI Study Tracks Rapid Comp Indemnity Growth Post-Pandemic

04/24/2024 |

0

![]() Indemnity benefits per claim grew at a “rapid” pace of 6% or more in 2022 in 16 out of 17 states analyzed by the Workers Compensation Research Institute, which said data before 2021 showed little change.

WCRI said the tight labor market led to wage growth across the board and increased the duration of temporary disability, which reflected “a growing share of new hires in the workforce and changes in comorbidities since the COVID-19 pandemic,” according to a statement on 14 research reports published Tuesday.

As highlighted by WCRI, Florida, Illinois, Michigan, Te...

Read More

Indemnity benefits per claim grew at a “rapid” pace of 6% or more in 2022 in 16 out of 17 states analyzed by the Workers Compensation Research Institute, which said data before 2021 showed little change.

WCRI said the tight labor market led to wage growth across the board and increased the duration of temporary disability, which reflected “a growing share of new hires in the workforce and changes in comorbidities since the COVID-19 pandemic,” according to a statement on 14 research reports published Tuesday.

As highlighted by WCRI, Florida, Illinois, Michigan, Te...

Read More

HI - Lawmakers Pass Cancer Presumption Bill and Nurse Payment Resolution

04/24/2024 |

0

![]() Hawaii lawmakers passed a bill that would add breast cancer and cancer of female reproductive organs to the list of conditions that are presumed compensable for firefighters.

At the same time, the Legislature passed a resolution asking the Department of Labor and Industrial Relations to clarify its rules to acknowledge the different appropriate payment rates for registered nurses and advanced practice registered nurses.

The Legislature sent HB 1889 to the governor on Friday. The bill, by Rep. Scott K. Saiki, D-McCull, would add breast cancer and cancer of female reproductive organs to the li...

Read More

Hawaii lawmakers passed a bill that would add breast cancer and cancer of female reproductive organs to the list of conditions that are presumed compensable for firefighters.

At the same time, the Legislature passed a resolution asking the Department of Labor and Industrial Relations to clarify its rules to acknowledge the different appropriate payment rates for registered nurses and advanced practice registered nurses.

The Legislature sent HB 1889 to the governor on Friday. The bill, by Rep. Scott K. Saiki, D-McCull, would add breast cancer and cancer of female reproductive organs to the li...

Read More

Sponsored Content

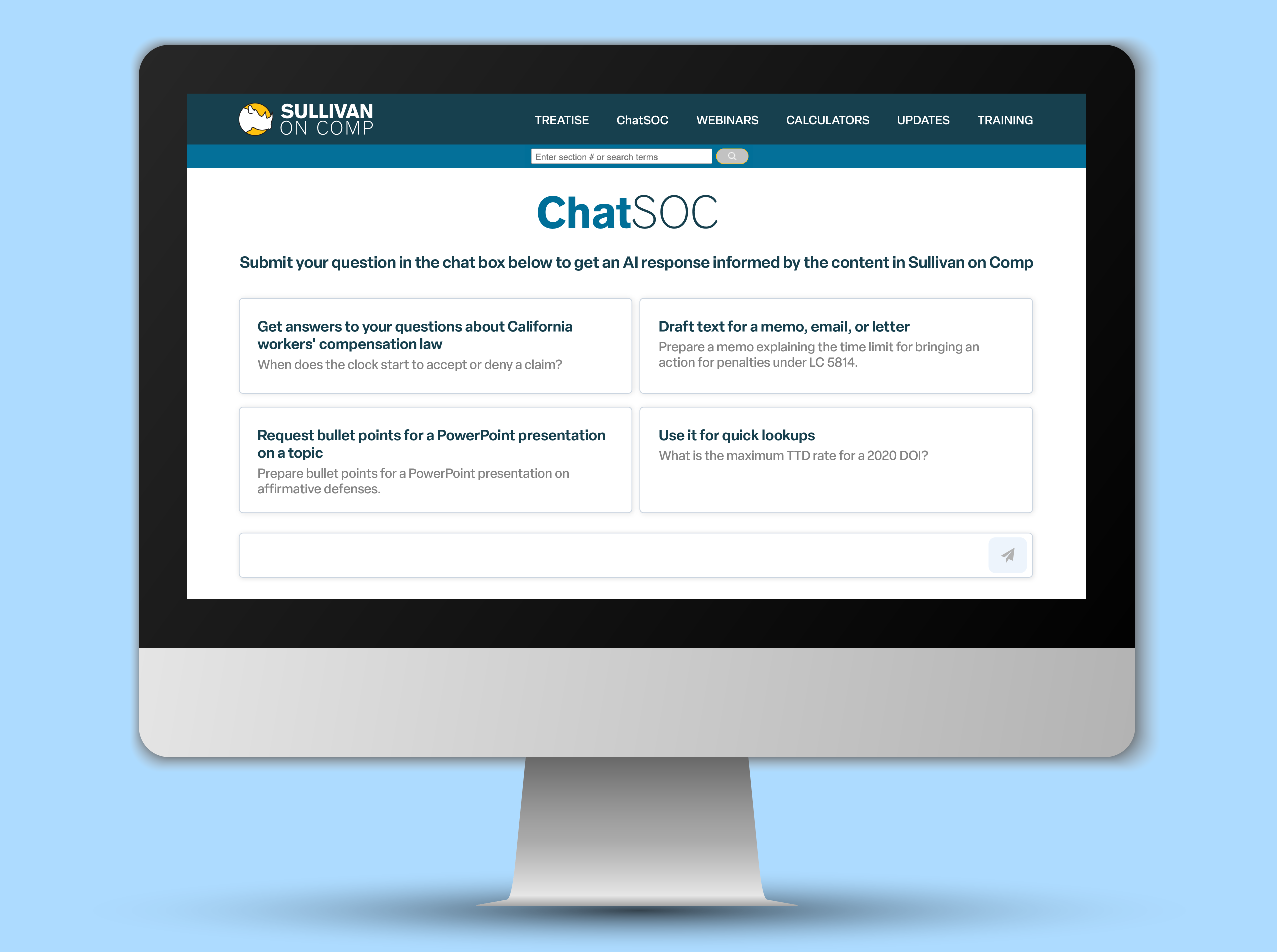

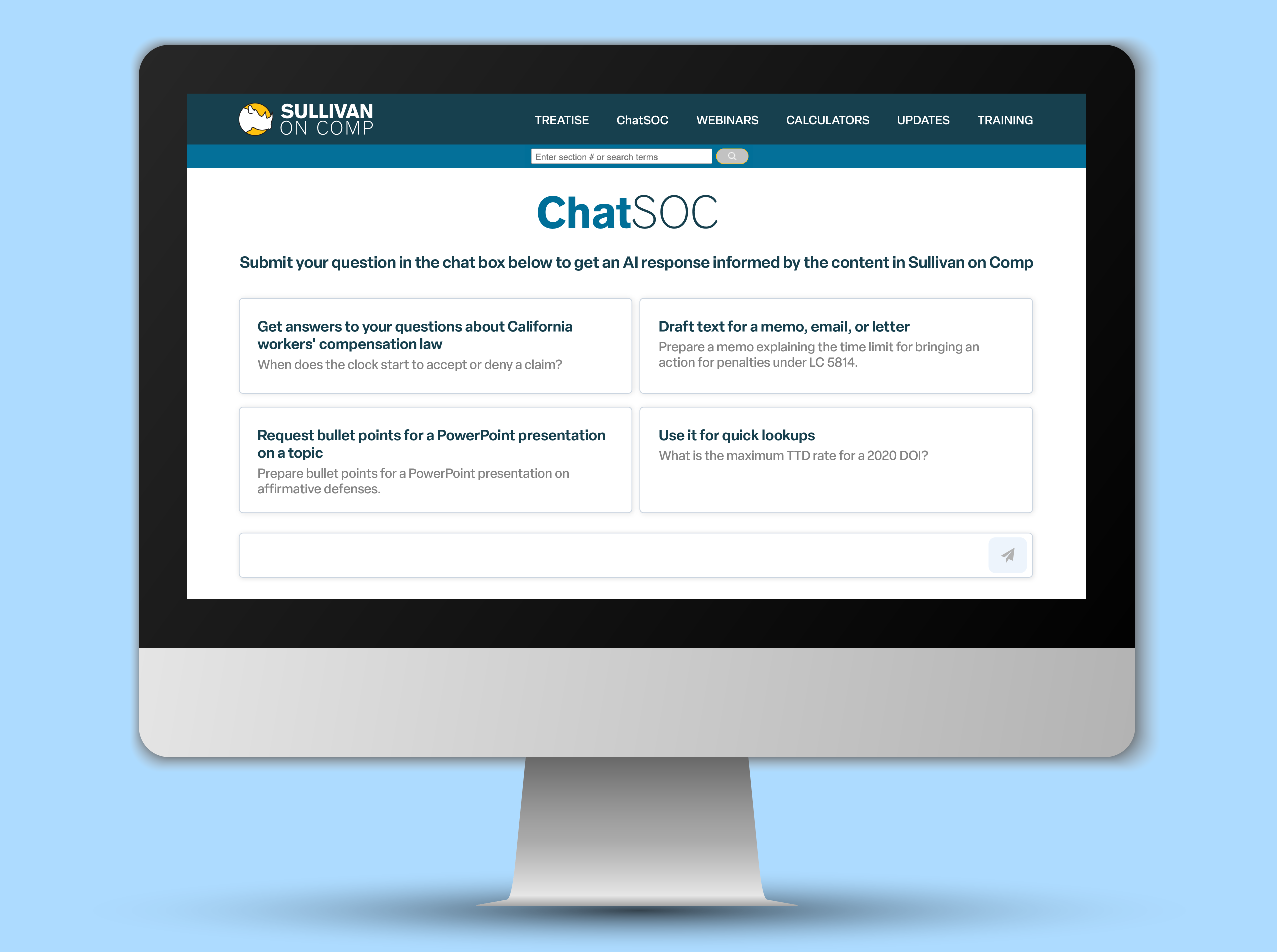

Press - Sullivan on Comp Launches ChatSOC, an Innovative Chatbot for California Workers' Compensation Professionals, Integrated with Authoritative Legal Treatise

04/22/2024 |

0

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

Post Your Press Release Here!

NE - Divided Supreme Court Reinstates Occupational Disease Claim for COVID-19

04/23/2024 |

0

![]() A divided Nebraska Supreme Court revived a health care worker’s occupational disease claim based on her COVID-19 infection in the early days of the pandemic.

Christine Thiele worked as a nurse liaison for Select Medical Corp., which operates a critical care recovery hospital adjacent to Bergan Mercy Hospital in Omaha.

In March 2020, at the outset of the COVID-19 pandemic, Select designated Thiele, who normally worked remotely, as an essential health care worker and required her to report to the hospital.

From March 16 to April 6, 2020, other than going to or conducting duties for work...

Read More

A divided Nebraska Supreme Court revived a health care worker’s occupational disease claim based on her COVID-19 infection in the early days of the pandemic.

Christine Thiele worked as a nurse liaison for Select Medical Corp., which operates a critical care recovery hospital adjacent to Bergan Mercy Hospital in Omaha.

In March 2020, at the outset of the COVID-19 pandemic, Select designated Thiele, who normally worked remotely, as an essential health care worker and required her to report to the hospital.

From March 16 to April 6, 2020, other than going to or conducting duties for work...

Read More

TX - High Court Orders Further Proceedings on Truck Driver's Status as 'Employee'

04/23/2024 |

0

![]() The Texas Supreme Court ruled that an injured truck driver’s claims against three related corporate entities had to be remanded for a determination of whether he qualified as their employee at the time of his wreck.

Case: JNM Express LLC v. Lozano, No. 21-0853, 04/19/2024, published.

Facts: Lauro Lozano fell asleep behind the wheel of a big rig in May 2015 while driving from Texas to Maryland. His truck collided with another rig, and Lozano suffered multiple severe injuries.

At the time of the accident, Lozano was driving a truck owned by JNM Express LLC that had been leased to A...

Read More

The Texas Supreme Court ruled that an injured truck driver’s claims against three related corporate entities had to be remanded for a determination of whether he qualified as their employee at the time of his wreck.

Case: JNM Express LLC v. Lozano, No. 21-0853, 04/19/2024, published.

Facts: Lauro Lozano fell asleep behind the wheel of a big rig in May 2015 while driving from Texas to Maryland. His truck collided with another rig, and Lozano suffered multiple severe injuries.

At the time of the accident, Lozano was driving a truck owned by JNM Express LLC that had been leased to A...

Read More

NY - Court Upholds Denial of Summary Judgment on Claims From Alleged Elevator Mishap

04/23/2024 |

0

![]() A New York appellate court issued a trio of opinions upholding a trial justice’s decision to allow a worker to proceed with his claims for negligence and violations of the Labor Law.

Case: Caracciolo v. SHS Ralph LLC, Nos. 2019-08578, 2019-08580, and 2021-02214, 04/17/2024, published.

Facts: Richard Caracciolo allegedly was injured during a construction project that was taking place on premises owned by SHS Ralph LLC. Wilcox Development Corp. was the general contractor.

Caracciolo worked for Thyssenkrupp Elevator Corp., a subcontractor. He allegedly fell one story to the ground after ...

Read More

A New York appellate court issued a trio of opinions upholding a trial justice’s decision to allow a worker to proceed with his claims for negligence and violations of the Labor Law.

Case: Caracciolo v. SHS Ralph LLC, Nos. 2019-08578, 2019-08580, and 2021-02214, 04/17/2024, published.

Facts: Richard Caracciolo allegedly was injured during a construction project that was taking place on premises owned by SHS Ralph LLC. Wilcox Development Corp. was the general contractor.

Caracciolo worked for Thyssenkrupp Elevator Corp., a subcontractor. He allegedly fell one story to the ground after ...

Read More

NY - No Summary Judgment for Worker on Labor Law Claims

04/23/2024 |

0

![]() A New York appellate court ruled that a worker was not entitled to summary judgment on any of his Labor Law claims and that the defendant was entitled to have one claim partially dismissed.

Case: Giraldo v. Highmark Independent LLC, No. 2020-02571, 04/17/2024, published.

Facts: Highmark Independent LLC hired Canyon Building & Design LLC as the general contractor for a school construction project. JC Duggan and Sublink Ltd. were both subcontractors for the project.

Mauro Giraldo worked for JC Duggan. He allegedly was injured when he was struck by a prefabricated modular unit as a cr...

Read More

A New York appellate court ruled that a worker was not entitled to summary judgment on any of his Labor Law claims and that the defendant was entitled to have one claim partially dismissed.

Case: Giraldo v. Highmark Independent LLC, No. 2020-02571, 04/17/2024, published.

Facts: Highmark Independent LLC hired Canyon Building & Design LLC as the general contractor for a school construction project. JC Duggan and Sublink Ltd. were both subcontractors for the project.

Mauro Giraldo worked for JC Duggan. He allegedly was injured when he was struck by a prefabricated modular unit as a cr...

Read More

MS - Governor Signs First Responder Death Benefits Bill

MS - Governor Signs First Responder Death Benefits Bill

04/23/2024 |

0

![]() Mississippi Gov. Tate Reeves on Saturday signed into law a bill that authorizes local governments to provide 60 days of pay to the beneficiaries of certain first responders who die in the line of duty.

The governor signed House Bill 1697, which enables counties, municipalities, public universities and others to pay the full compensation of any law enforcement officer, firefighter or emergency medical technician who is killed on the job.

The benefits would not be paid out in the event the on-duty death was a suicide.

Death compensation benefits would be paid to designated beneficiaries. If t...

Read More

Mississippi Gov. Tate Reeves on Saturday signed into law a bill that authorizes local governments to provide 60 days of pay to the beneficiaries of certain first responders who die in the line of duty.

The governor signed House Bill 1697, which enables counties, municipalities, public universities and others to pay the full compensation of any law enforcement officer, firefighter or emergency medical technician who is killed on the job.

The benefits would not be paid out in the event the on-duty death was a suicide.

Death compensation benefits would be paid to designated beneficiaries. If t...

Read More

SC - Senate Passes Resolution to Approve Electronic Payments

04/23/2024 |

0

![]() The South Carolina Senate passed a resolution authorizing electronic payments for certain workers’ compensation benefits.

The Senate on Friday unanimously passed S 1266, a joint resolution by the Senate Judiciary Committee.

If passed by the state House of Representatives, the resolution would satisfy the requirement that the legislature approve amendments to Regulation 67-1602 “to modernize the payment of compensation to claimants by codifying circumstances where use of electronic payment is mandatory and where use of a check is permissive.”

The Workers’ Compensation...

Read More

The South Carolina Senate passed a resolution authorizing electronic payments for certain workers’ compensation benefits.

The Senate on Friday unanimously passed S 1266, a joint resolution by the Senate Judiciary Committee.

If passed by the state House of Representatives, the resolution would satisfy the requirement that the legislature approve amendments to Regulation 67-1602 “to modernize the payment of compensation to claimants by codifying circumstances where use of electronic payment is mandatory and where use of a check is permissive.”

The Workers’ Compensation...

Read More

CO - Committee Passes Bill to Strip State's Right to Self-Insure

04/23/2024 |

0

![]() The Colorado Senate Appropriations Committee passed a bill that would strip the right of the state to self-insure its workers’ compensation risks.

Senate Bill 149, by Sen. Nick Hinrichsen, D-Pueblo, would require the state Department of Personnel and Administration to annually solicit three quotes for work comp coverage from Pinnacol Assurance, the state-chartered comp carrier, and three other insurers. The department would be required to present the quotes to the General Assembly for approval, under terms of the bill.

SB 149 would additionally prohibit the state from suggesting or req...

Read More

The Colorado Senate Appropriations Committee passed a bill that would strip the right of the state to self-insure its workers’ compensation risks.

Senate Bill 149, by Sen. Nick Hinrichsen, D-Pueblo, would require the state Department of Personnel and Administration to annually solicit three quotes for work comp coverage from Pinnacol Assurance, the state-chartered comp carrier, and three other insurers. The department would be required to present the quotes to the General Assembly for approval, under terms of the bill.

SB 149 would additionally prohibit the state from suggesting or req...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More