OH - Court Rejects Worker's Intentional Tort Claim, Motion for Post-Judgment Relief

05/01/2024 |

0

![]() An Ohio appellate court upheld the summary dismissal of a worker’s intentional tort claim against his employer, as well as the denial of post-judgment relief based on the employer’s misconduct.

Eugene Moore worked for ThorWorks Industries Inc. He suffered serious injuries in July 2019 when he fell into an unguarded mixer.

Three months before the accident, an official from the Occupational Safety and Health Administration informed management that the openings to the mixing tank needed to be guarded.

After the accident, Moore testified that he had almost fallen into the mixer...

Read More

An Ohio appellate court upheld the summary dismissal of a worker’s intentional tort claim against his employer, as well as the denial of post-judgment relief based on the employer’s misconduct.

Eugene Moore worked for ThorWorks Industries Inc. He suffered serious injuries in July 2019 when he fell into an unguarded mixer.

Three months before the accident, an official from the Occupational Safety and Health Administration informed management that the openings to the mixing tank needed to be guarded.

After the accident, Moore testified that he had almost fallen into the mixer...

Read More

TN - Exclusive Remedy Shields Store From Sales Representative's Tort Claims

05/01/2024 |

0

![]() A divided Tennessee Court of Appeals ruled that a sales representative for a product vendor could not pursue a civil remedy from the store where he was injured.

Case: Coblentz v. Tractor Supply Co., No. M2023-00249-COA-R3-CV, 04/26/2024, published.

Facts: Brian Coblentz worked as an outside sales representative for Stanley National Hardware. The job required him to visit various hardware stores in his region every four to six weeks.

On Aug. 29, 2012, Coblentz visited a Tractor Supply store in Fayetteville, Tennessee. He suffered injuries when a 12-foot steel barn door track fell out of the ...

Read More

A divided Tennessee Court of Appeals ruled that a sales representative for a product vendor could not pursue a civil remedy from the store where he was injured.

Case: Coblentz v. Tractor Supply Co., No. M2023-00249-COA-R3-CV, 04/26/2024, published.

Facts: Brian Coblentz worked as an outside sales representative for Stanley National Hardware. The job required him to visit various hardware stores in his region every four to six weeks.

On Aug. 29, 2012, Coblentz visited a Tractor Supply store in Fayetteville, Tennessee. He suffered injuries when a 12-foot steel barn door track fell out of the ...

Read More

NY - Court Overturns Denial of Benefits for WTC Work

05/01/2024 |

0

![]() A New York appellate court overturned a denial of benefits to a court employee for his participation in the World Trade Center rescue, recovery and cleanup operations.

Case: Matter of Liotta v. New York State Unified Court System, No. CV-23-0103, 04/25/2024, published.

Facts: Robert Liotta is a senior court officer at 100 Centre St. in New York City. He was at work on Sept. 11, 2001, when the terrorist attack on the World Trade Center occurred.

According to Liotta, as the attack on the WTC unfolded, he assisted in evacuating the courthouse and the building across the street, movin...

Read More

A New York appellate court overturned a denial of benefits to a court employee for his participation in the World Trade Center rescue, recovery and cleanup operations.

Case: Matter of Liotta v. New York State Unified Court System, No. CV-23-0103, 04/25/2024, published.

Facts: Robert Liotta is a senior court officer at 100 Centre St. in New York City. He was at work on Sept. 11, 2001, when the terrorist attack on the World Trade Center occurred.

According to Liotta, as the attack on the WTC unfolded, he assisted in evacuating the courthouse and the building across the street, movin...

Read More

NY - Court Upholds Denial of Worker's Request for Reconsideration

05/01/2024 |

0

![]() A New York appellate court upheld a decision denying reconsideration of a worker’s rejected claim due to her failure to provide timely notice.

Case: Matter of Medina v. American Maintenance Inc., No. CV-23-0370, 04/25/2024, published.

Facts: Delmi Medina worked for American Maintenance Inc. as a housekeeper. She filed a workers’ compensation claim in February 2022, asserting that she suffered injuries to her back and knees the previous February.

Procedural history: A workers’ compensation law judge found that Medina had suffered a compensable injury to her back and kn...

Read More

A New York appellate court upheld a decision denying reconsideration of a worker’s rejected claim due to her failure to provide timely notice.

Case: Matter of Medina v. American Maintenance Inc., No. CV-23-0370, 04/25/2024, published.

Facts: Delmi Medina worked for American Maintenance Inc. as a housekeeper. She filed a workers’ compensation claim in February 2022, asserting that she suffered injuries to her back and knees the previous February.

Procedural history: A workers’ compensation law judge found that Medina had suffered a compensable injury to her back and kn...

Read More

Sponsored Content

Press - Centre for Neuro Skills Promotes Dallas-based Dr. Stefanie Howell to Director of Research Integration

03/12/2024 |

0

Centre for Neuro Skills Promotes Dallas-based Dr. Stefanie Howell to Director of Research Integration

Bakersfield, Calif. (March 12, 2024) � Centre for Neuro Skills (CNS), a leader in traumatic brain injury and stroke rehabilitation services, today announced the promotion of Stefanie N. Howell, Ph.D., CBIS, to director of research integration.

�Stefanie has been integral to Centre for Neuro Skills� research program, looking closely at how we can not only improve the lives of our patients but people with brain injuries everywhere,� said David Harrington, president and CEO of Centre fo...

Read More

Post Your Press Release Here!

Industry Insights

UT - Wickert: How to Sue Yourself and Win

By Gary L. Wickert

05/01/2024 |

0

![]() The American horror film “Split,” directed by M. Night Shyamalan, is a psychological thriller that centers on a bizarre antagonist with 23 separate personalities. Without spoiling the plot, suffice it to say that it focuses on the fact that there is something to the adage “mind over matter.”

They say that life imitates art. If you prefer Woody Allen’s slant on it, “Life doesn’t imitate art, it imitates bad television.” Both statements appear to be true in a growing number of cases where personal representatives in death cases are actually be...

Read More

The American horror film “Split,” directed by M. Night Shyamalan, is a psychological thriller that centers on a bizarre antagonist with 23 separate personalities. Without spoiling the plot, suffice it to say that it focuses on the fact that there is something to the adage “mind over matter.”

They say that life imitates art. If you prefer Woody Allen’s slant on it, “Life doesn’t imitate art, it imitates bad television.” Both statements appear to be true in a growing number of cases where personal representatives in death cases are actually be...

Read More

OK - House Passes Legacy Court, Mental Health Coverage Bills

05/01/2024 |

0

![]() The Oklahoma state House of Representatives passed bills that would require the Court of Civil Appeals to take up responsibility for legacy comp claims and exempt public safety workers from the prohibition on so-called “mental-mental” claims.

Both SB 1456 and SB 1457 were amended before the House passed them and will have to return to the Senate for concurrence. The amendments don't change anything substantive in the bills but represent a common legislative maneuver to funnel them into a conference committee.

The House on Thursday voted 77-0 to pass SB 1456, by...

Read More

The Oklahoma state House of Representatives passed bills that would require the Court of Civil Appeals to take up responsibility for legacy comp claims and exempt public safety workers from the prohibition on so-called “mental-mental” claims.

Both SB 1456 and SB 1457 were amended before the House passed them and will have to return to the Senate for concurrence. The amendments don't change anything substantive in the bills but represent a common legislative maneuver to funnel them into a conference committee.

The House on Thursday voted 77-0 to pass SB 1456, by...

Read More

NATL. - AP Sources: DEA to Reclassify Cannabis as Schedule III Controlled Substance

05/01/2024 |

0

![]() The U.S. Drug Enforcement Administration is reportedly planning to reclassify cannabis as a Schedule III controlled substance, according to an Associated Press story citing anonymous sources.

Cannabis is currently a Schedule I controlled substance, indicating that it has no accepted or recognized medical use and a high potential for abuse. The AP reports that five people familiar with the matter said the DEA is proposing to classify the drug alongside codeine, ketamine and some steroids as a Schedule III drug, indicating that it has medical uses and a moderate or low potential for abuse.

The...

Read More

The U.S. Drug Enforcement Administration is reportedly planning to reclassify cannabis as a Schedule III controlled substance, according to an Associated Press story citing anonymous sources.

Cannabis is currently a Schedule I controlled substance, indicating that it has no accepted or recognized medical use and a high potential for abuse. The AP reports that five people familiar with the matter said the DEA is proposing to classify the drug alongside codeine, ketamine and some steroids as a Schedule III drug, indicating that it has medical uses and a moderate or low potential for abuse.

The...

Read More

NATL. - Enlyte: Opioids Continue to Drop, Migraine Meds on the Rise

NATL. - Enlyte: Opioids Continue to Drop, Migraine Meds on the Rise

05/01/2024 |

0

![]() Opioid prescriptions per workers’ compensation claim dropped by 9.7% in 2023, spearheading drops in prescribing of other common alternative medications used to manage pain, according to a drug trends report released Tuesday by Enlyte LLC.

Anticonvulsants, or neurological drugs intended to manage nerve pain, had the second-largest drop in utilization at 7.4%. Antidepressants and non-steroidal anti-inflammatory drugs, both used to help manage pain, had 6.1% and 3% decreases, respectively, according to the report.

Overall, Enlyte’s data showed dips in prescribing across the board wi...

Read More

Opioid prescriptions per workers’ compensation claim dropped by 9.7% in 2023, spearheading drops in prescribing of other common alternative medications used to manage pain, according to a drug trends report released Tuesday by Enlyte LLC.

Anticonvulsants, or neurological drugs intended to manage nerve pain, had the second-largest drop in utilization at 7.4%. Antidepressants and non-steroidal anti-inflammatory drugs, both used to help manage pain, had 6.1% and 3% decreases, respectively, according to the report.

Overall, Enlyte’s data showed dips in prescribing across the board wi...

Read More

TX - Judge Errs in Consolidating Worker's Civil Suit With Putative Employer's Appeal

04/30/2024 |

0

![]() A Texas appellate court ruled that a trial judge erred in consolidating a worker’s civil suit with his putative employer’s challenge to an administrative finding that the worker was not its employee.

In September 2021, Romny Sanchez joined his uncle Leonel Yanez on a job providing remediation services to victims of Hurricane Ida in Louisiana. Yanez worked for All Repair and Restoration LLC.

Joe Saavedra, another All Repair employee, also came to work on the job.

Sanchez and Yanez suffered injuries in a vehicle accident on the job while Saavedra was driving.

Sanchez an...

Read More

A Texas appellate court ruled that a trial judge erred in consolidating a worker’s civil suit with his putative employer’s challenge to an administrative finding that the worker was not its employee.

In September 2021, Romny Sanchez joined his uncle Leonel Yanez on a job providing remediation services to victims of Hurricane Ida in Louisiana. Yanez worked for All Repair and Restoration LLC.

Joe Saavedra, another All Repair employee, also came to work on the job.

Sanchez and Yanez suffered injuries in a vehicle accident on the job while Saavedra was driving.

Sanchez an...

Read More

Sponsored Content

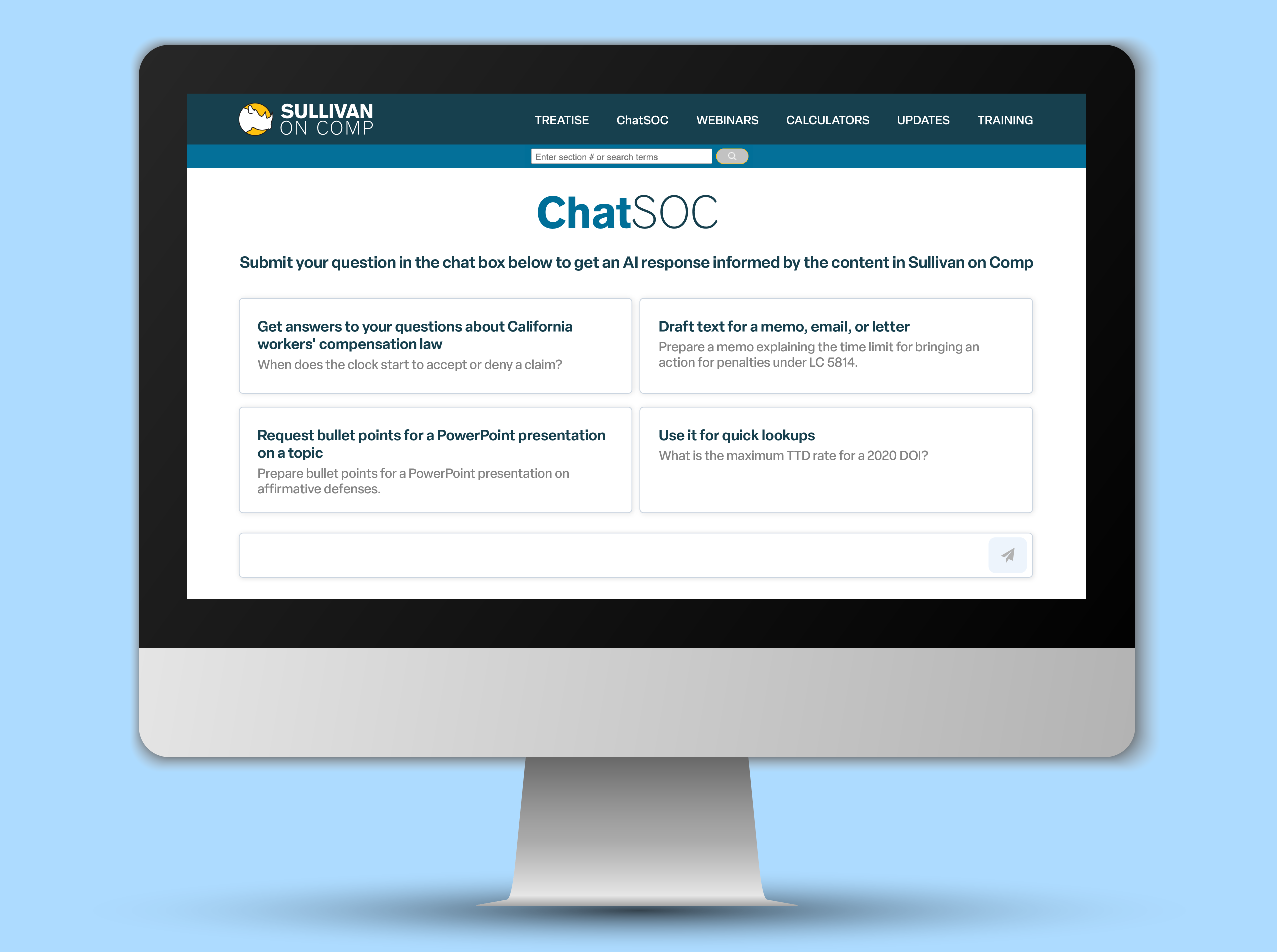

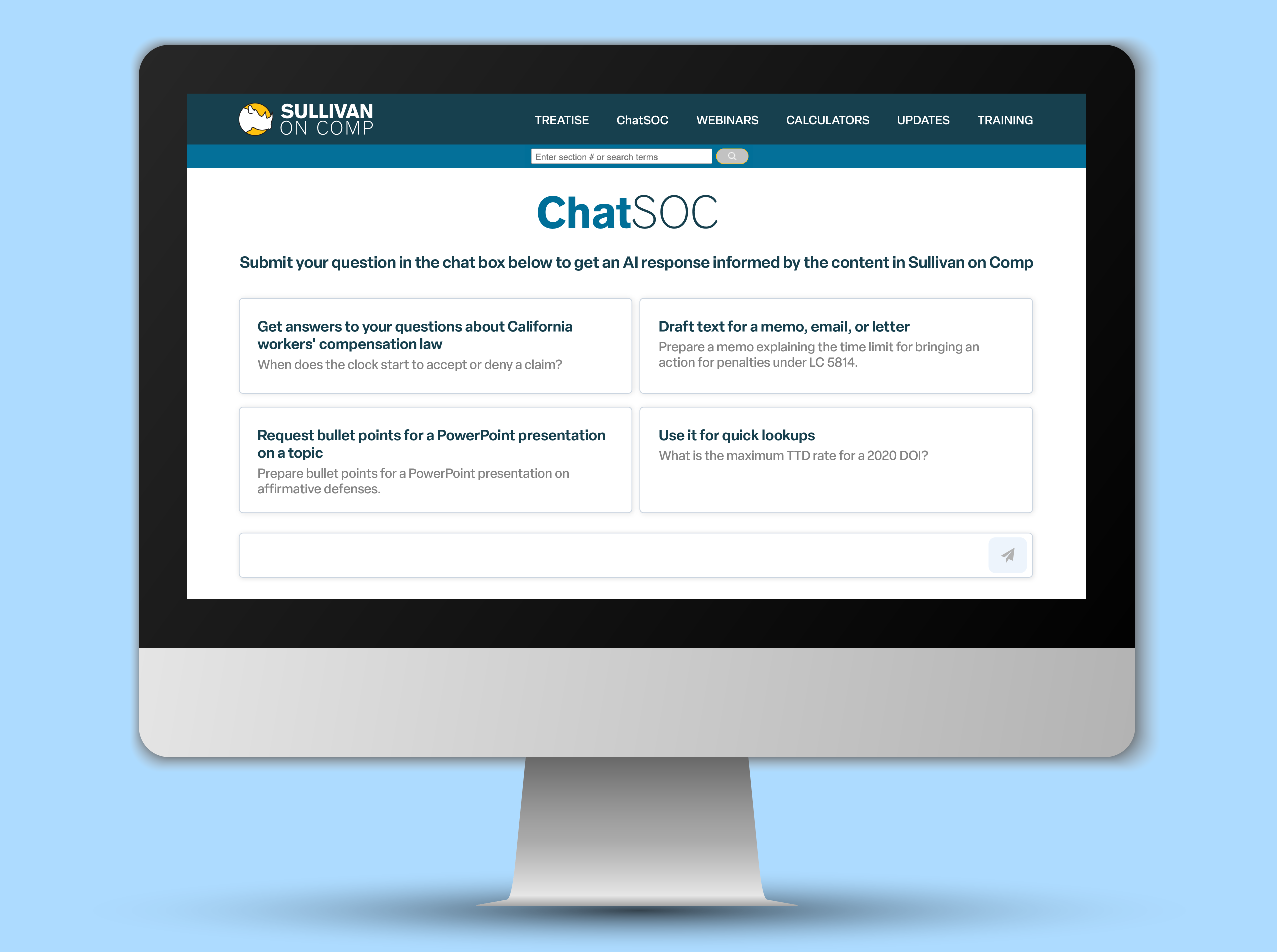

Press - Sullivan on Comp Launches ChatSOC, an Innovative Chatbot for California Workers' Compensation Professionals, Integrated with Authoritative Legal Treatise

04/22/2024 |

0

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

Post Your Press Release Here!

MT - Court Order Compels Worker to Travel 150 Miles for Psychiatric IME

04/30/2024 |

0

![]() The Montana Workers’ Compensation Court issued an order compelling an injured worker to travel 150 miles from home to undergo a psychiatric evaluation.

Case: Neisinger v. New Hampshire Insurance Co., No. 2024-00340, 04/25/2024, published.

Facts: Michael Neisinger lives in Cascade, Montana. He sustained injuries in May 2015 when a high-pressure water jet stream tore into his left leg, spun him around and knocked him off a platform.

Neisinger’s employer had workers’ compensation coverage with New Hampshire Insurance Co., which accepted liability for the injuries.

...

Read More

The Montana Workers’ Compensation Court issued an order compelling an injured worker to travel 150 miles from home to undergo a psychiatric evaluation.

Case: Neisinger v. New Hampshire Insurance Co., No. 2024-00340, 04/25/2024, published.

Facts: Michael Neisinger lives in Cascade, Montana. He sustained injuries in May 2015 when a high-pressure water jet stream tore into his left leg, spun him around and knocked him off a platform.

Neisinger’s employer had workers’ compensation coverage with New Hampshire Insurance Co., which accepted liability for the injuries.

...

Read More

NY - Worker Presents Insufficient Evidence to Establish CT Injury

04/30/2024 |

0

![]() A New York appellate court upheld the denial of a worker’s claim for benefits for alleged repetitive trauma injuries as supported by insufficient evidence.

Case: Matter of Morgan v. Kinray Inc., No. CV-23-0563, 04/25/2024, published.

Facts: Dexter Morgan worked for Kinray Inc. as a warehouse associate. He filed a claim for workers’ compensation benefits, alleging he suffered injuries from the repetitive motions and use of his arms, hands, legs, neck and back while engaged in heavy lifting, reaching and squatting.

Morgan alleged that the onset of his injuries was on Jan...

Read More

A New York appellate court upheld the denial of a worker’s claim for benefits for alleged repetitive trauma injuries as supported by insufficient evidence.

Case: Matter of Morgan v. Kinray Inc., No. CV-23-0563, 04/25/2024, published.

Facts: Dexter Morgan worked for Kinray Inc. as a warehouse associate. He filed a claim for workers’ compensation benefits, alleging he suffered injuries from the repetitive motions and use of his arms, hands, legs, neck and back while engaged in heavy lifting, reaching and squatting.

Morgan alleged that the onset of his injuries was on Jan...

Read More

NY - Worker Gets Benefits for Injuries From Mysterious Fall

04/30/2024 |

0

![]() A New York appellate court upheld an award of benefits to a home health care worker for her injuries from a fall from an unknown cause.

Case: Matter of Bosque v. Prime Support Inc., No. CV-23-0221, 04/25/2024, published.

Facts: Annette Bosque worked for Prime Support Inc. as a home health care aide. She fell in a hallway after cleaning her patient's bedroom. The patient’s mother later found her face down on the floor, unconscious.

Bosque was taken to the hospital and diagnosed with a subarachnoid hemorrhage, central cord syndrome and mild traumatic brain injury.

Procedural h...

Read More

A New York appellate court upheld an award of benefits to a home health care worker for her injuries from a fall from an unknown cause.

Case: Matter of Bosque v. Prime Support Inc., No. CV-23-0221, 04/25/2024, published.

Facts: Annette Bosque worked for Prime Support Inc. as a home health care aide. She fell in a hallway after cleaning her patient's bedroom. The patient’s mother later found her face down on the floor, unconscious.

Bosque was taken to the hospital and diagnosed with a subarachnoid hemorrhage, central cord syndrome and mild traumatic brain injury.

Procedural h...

Read More

NY - Report Cites High Rate of Injury, Assault on NYC Delivery Workers

04/30/2024 |

0

![]() Gig workers delivering food in New York City report high rates of injury and assaults, according to a study published Monday in the Journal of Urban Health.

The City University of New York surveyed more than 1,600 gig workers and found that 22% reported being injured while working and another 21% reported being assaulted on the job.

According to the university, survey respondents who said they used electric bikes or mopeds to deliver food were more than twice as likely to be injured or assaulted.

The survey also reportedly found that despite being characterized as a part-time job for those ...

Read More

Gig workers delivering food in New York City report high rates of injury and assaults, according to a study published Monday in the Journal of Urban Health.

The City University of New York surveyed more than 1,600 gig workers and found that 22% reported being injured while working and another 21% reported being assaulted on the job.

According to the university, survey respondents who said they used electric bikes or mopeds to deliver food were more than twice as likely to be injured or assaulted.

The survey also reportedly found that despite being characterized as a part-time job for those ...

Read More

NATL. - OccMD Partners With Private Equity Firm Council Capital

04/30/2024 |

0

![]() OccMD announced a partnership with private equity firm Council Capital.

Dallas-based OccMD provides medical management services for companies whose workers have complex work-related injuries or illnesses.

The company said it will use Council Capital’s investment to expand its services and grow into more states and lines of business.

The transaction closed March 20. Terms of the deal were not disclosed.

Council Capital is a health care-focused private equity firm based in Nashville, Tennessee.

...

Read More

OccMD announced a partnership with private equity firm Council Capital.

Dallas-based OccMD provides medical management services for companies whose workers have complex work-related injuries or illnesses.

The company said it will use Council Capital’s investment to expand its services and grow into more states and lines of business.

The transaction closed March 20. Terms of the deal were not disclosed.

Council Capital is a health care-focused private equity firm based in Nashville, Tennessee.

...

Read More

NATL. - CLARA Analytics, Origami Risk Announce Partnership

04/30/2024 |

0

![]() CLARA Analytics and Origami Risk announced a partnership to accelerate the adoption of artificial intelligence in the insurance industry.

The partnership will give risk managers access to secure technology that’s compliant with cybersecurity standards for certified public accountants as well as the Health Insurance Portability and Accountability Act, or HIPAA.

“Self-insured organizations, insurers, risk pools, MGAs and others already using Origami can gain new AI-driven insights to help them identify high-risk claims, improve collaboration with third-party administrators, optimiz...

Read More

CLARA Analytics and Origami Risk announced a partnership to accelerate the adoption of artificial intelligence in the insurance industry.

The partnership will give risk managers access to secure technology that’s compliant with cybersecurity standards for certified public accountants as well as the Health Insurance Portability and Accountability Act, or HIPAA.

“Self-insured organizations, insurers, risk pools, MGAs and others already using Origami can gain new AI-driven insights to help them identify high-risk claims, improve collaboration with third-party administrators, optimiz...

Read More

OH - Worker Can Get SLU Award for Loss Caused by Brain Injury

04/29/2024 |

0

![]() An Ohio appellate court ruled that an award for a worker’s loss of use of his limbs may be available when medical evidence shows that loss is the result of brain injury, not direct trauma to the extremities.

Bohdanus Byk was a laborer for Republic Steel. He slipped and fell from a platform in August 2012, suffering severe head injuries, which caused trauma to his brain.

Byk underwent a right frontal decompressive craniectomy, but he remained in a persistent vegetative state for almost three years until he died.

Before Byk’s death, an application was filed with the Industria...

Read More

An Ohio appellate court ruled that an award for a worker’s loss of use of his limbs may be available when medical evidence shows that loss is the result of brain injury, not direct trauma to the extremities.

Bohdanus Byk was a laborer for Republic Steel. He slipped and fell from a platform in August 2012, suffering severe head injuries, which caused trauma to his brain.

Byk underwent a right frontal decompressive craniectomy, but he remained in a persistent vegetative state for almost three years until he died.

Before Byk’s death, an application was filed with the Industria...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More