MS - Court Upholds Denial of Worker's Request for Additional Benefits, Claim of Additional Injuries

04/26/2024 |

0

![]() The Mississippi Court of Appeals upheld the denial of a worker’s claim for additional benefits and a second alleged workplace injury.

Mary Tillman worked for Home Depot. She injured her back at work in January 2016 while helping a customer lift floor tiles onto a cart. Tillman reported her injury to the assistant manager, who then reported it to a store manager.

Tillman filled out an incident report and continued to work the rest of her shift. The next day, she went to the emergency room seeking treatment for back pain, but she continued to report to work in the days that followed.

In...

Read More

The Mississippi Court of Appeals upheld the denial of a worker’s claim for additional benefits and a second alleged workplace injury.

Mary Tillman worked for Home Depot. She injured her back at work in January 2016 while helping a customer lift floor tiles onto a cart. Tillman reported her injury to the assistant manager, who then reported it to a store manager.

Tillman filled out an incident report and continued to work the rest of her shift. The next day, she went to the emergency room seeking treatment for back pain, but she continued to report to work in the days that followed.

In...

Read More

MO - Worker's Challenge to Claim Dismissal Tossed as Untimely

04/26/2024 |

0

![]() A Missouri appellate court ruled that a worker’s challenge to the dismissal of her claim had to be dismissed as untimely.

Case: Godfrey v. Metropolitan St. Louis Sewer District, No. ED111833, 04/23/2024, published.

Facts and procedural history: Tamar Godfrey worked for the Metropolitan St. Louis Sewer District. She allegedly suffered an injury at work in November 2015 and filed a workers’ compensation claim in April 2021.

Godfrey failed to produce any evidence in support of her workers’ compensation claim despite being granted multiple continuances. The district then reque...

Read More

A Missouri appellate court ruled that a worker’s challenge to the dismissal of her claim had to be dismissed as untimely.

Case: Godfrey v. Metropolitan St. Louis Sewer District, No. ED111833, 04/23/2024, published.

Facts and procedural history: Tamar Godfrey worked for the Metropolitan St. Louis Sewer District. She allegedly suffered an injury at work in November 2015 and filed a workers’ compensation claim in April 2021.

Godfrey failed to produce any evidence in support of her workers’ compensation claim despite being granted multiple continuances. The district then reque...

Read More

NY - Court Upholds Summary Judgment for Worker's Demolition Accident

04/26/2024 |

0

![]() A New York appellate court upheld a grant of partial summary judgment in favor of a worker for his injuries from a demolition accident.

Case: Mata v. 371 1st Street LLC, No. 20700/17, 04/23/2024, published.

Facts: Jonathan Mata was engaged in the demolition of flooring when the subfloor collapsed. He fell several stories and onto a scaffold, suffering injuries.

Procedural history: Mata filed suit against multiple defendants, asserting claims for negligence and violations of the Labor Law.

The defendants moved for summary judgment dismissing the claims, and Mata moved for summary judgment o...

Read More

A New York appellate court upheld a grant of partial summary judgment in favor of a worker for his injuries from a demolition accident.

Case: Mata v. 371 1st Street LLC, No. 20700/17, 04/23/2024, published.

Facts: Jonathan Mata was engaged in the demolition of flooring when the subfloor collapsed. He fell several stories and onto a scaffold, suffering injuries.

Procedural history: Mata filed suit against multiple defendants, asserting claims for negligence and violations of the Labor Law.

The defendants moved for summary judgment dismissing the claims, and Mata moved for summary judgment o...

Read More

NY - Worker Who Fell Through Duct Opening Entitled to Summary Judgment

04/26/2024 |

0

![]() A New York appellate court upheld a grant of summary judgment to a worker for his injuries from a fall through a duct hole.

Case: Guaraca v. West 25th Street Housing Development Fund Corp., No. 24945/17, 43004/18, 04/23/2024.

Facts: Segundo Juan Guaraca was instructed to build a wall around a trash chute hole that was adjacent to an air conditioning duct on the second floor of a building.

When Guaraca allegedly jumped on a piece of plywood covering the duct hole to test its strength, the unsecured planking cracked, and he fell two stories to the basement, seriously injuring himself.

Proced...

Read More

A New York appellate court upheld a grant of summary judgment to a worker for his injuries from a fall through a duct hole.

Case: Guaraca v. West 25th Street Housing Development Fund Corp., No. 24945/17, 43004/18, 04/23/2024.

Facts: Segundo Juan Guaraca was instructed to build a wall around a trash chute hole that was adjacent to an air conditioning duct on the second floor of a building.

When Guaraca allegedly jumped on a piece of plywood covering the duct hole to test its strength, the unsecured planking cracked, and he fell two stories to the basement, seriously injuring himself.

Proced...

Read More

Sponsored Content

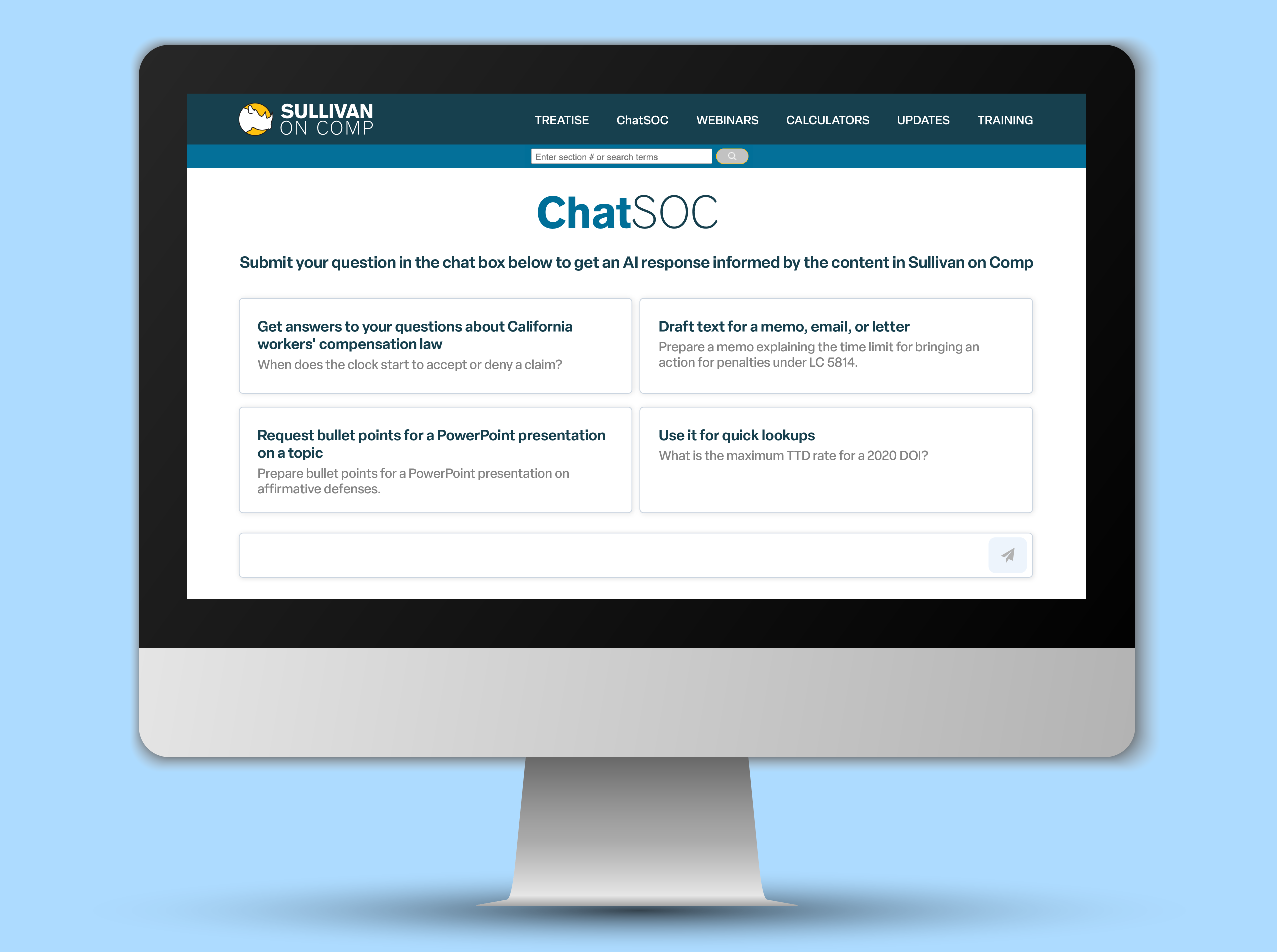

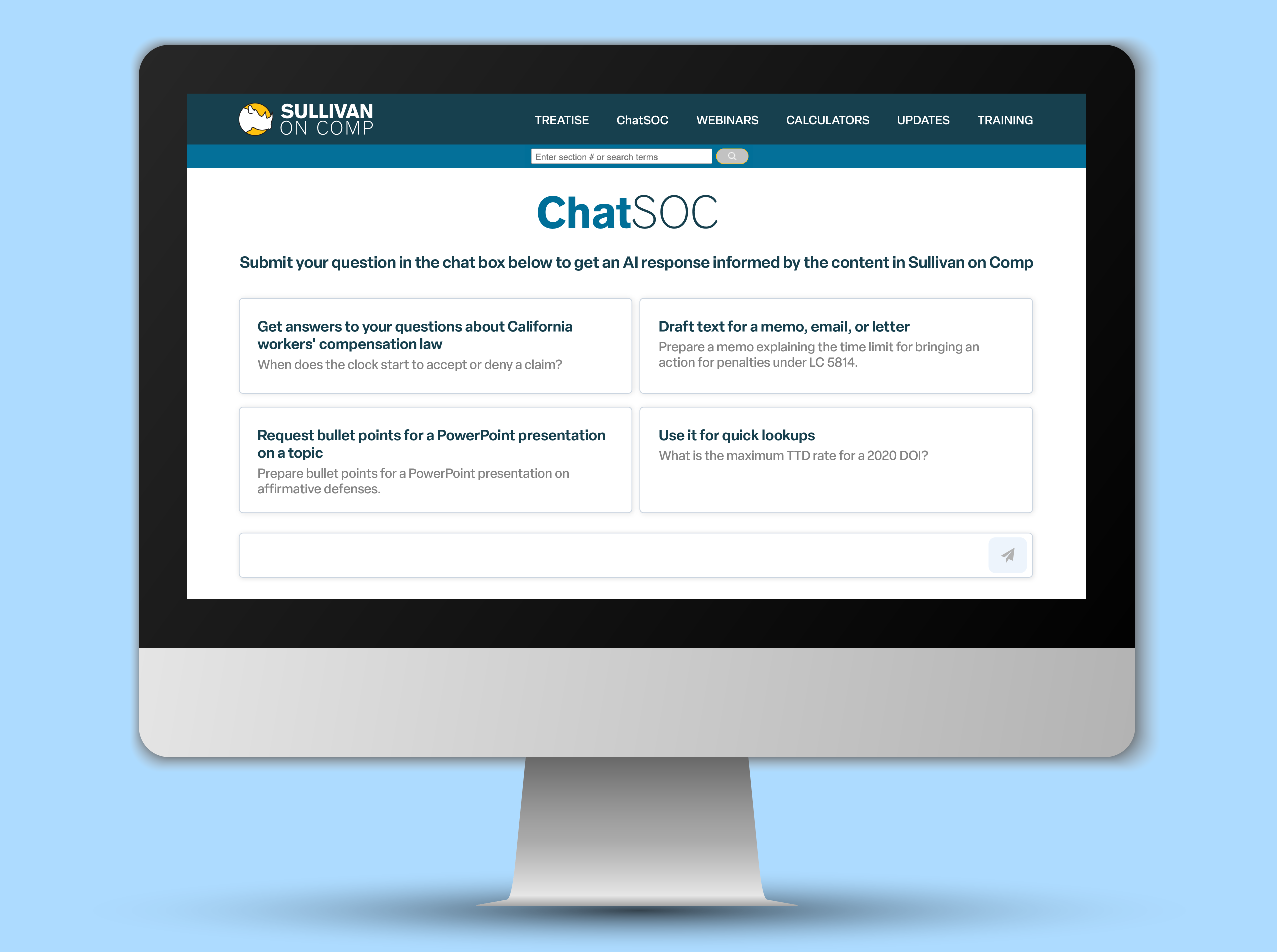

Press - Sullivan on Comp Launches ChatSOC, an Innovative Chatbot for California Workers' Compensation Professionals, Integrated with Authoritative Legal Treatise

04/22/2024 |

0

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

Post Your Press Release Here!

Industry Insights

FL - Langham: Uniformity in Regulations

By Judge David Langham

04/25/2024 |

0

![]() On April 11, Gov. Ron DeSantis signed CS/CS/HB 433. That designation, as we have noted previously, has meaning.

The "CS" reflects that the bill that was signed is not the same as the one that was introduced in the House of Representatives. The "CS" stands for "committee substitute," and since this bill has that twice in the name, there is evidence of significant effort and alteration between filing and passage. What eventually passed was the second committee substitute.

The "HB" is noteworthy also. That tells the reader that the bill originate...

Read More

On April 11, Gov. Ron DeSantis signed CS/CS/HB 433. That designation, as we have noted previously, has meaning.

The "CS" reflects that the bill that was signed is not the same as the one that was introduced in the House of Representatives. The "CS" stands for "committee substitute," and since this bill has that twice in the name, there is evidence of significant effort and alteration between filing and passage. What eventually passed was the second committee substitute.

The "HB" is noteworthy also. That tells the reader that the bill originate...

Read More

CA - Committee Passes Bill to Eliminate Contractor Comp Coverage Requirement

04/26/2024 |

1

![]() A California Senate committee recently passed a bill that would relieve contractors of the requirement to carry workers’ compensation and provide proof of coverage when seeking a license, even if they have no employees.

The Senate Business, Professions and Economic Development Committee voted 12-0 on Monday to pass SB 1071, by Sen. Bill Dodd, D-Napa.

A law set to take effect in 2026 would require all contractors to provide proof of work comp coverage when applying for a license. The requirement to carry work comp coverage and provide proof is set to apply regardless of whether a contra...

Read More

A California Senate committee recently passed a bill that would relieve contractors of the requirement to carry workers’ compensation and provide proof of coverage when seeking a license, even if they have no employees.

The Senate Business, Professions and Economic Development Committee voted 12-0 on Monday to pass SB 1071, by Sen. Bill Dodd, D-Napa.

A law set to take effect in 2026 would require all contractors to provide proof of work comp coverage when applying for a license. The requirement to carry work comp coverage and provide proof is set to apply regardless of whether a contra...

Read More

CA - Appropriations Committee Passes E-Signature Bill

04/26/2024 |

0

![]() The California Assembly Appropriations Committee unanimously passed a bill that would allow electronic signatures in proceedings before the Workers’ Compensation Appeals Board.

The committee on Wednesday voted 14-0 to pass bills on its consent file, which included Assembly Bill 2337, by Assemblymember Diane Dixon, R-Newport Beach. An analysis prepared for the committee projects that the costs of authorizing electronic signatures would be negligible.

The WCAB allowed electronic signatures during the COVID-19 pandemic but reverted to requiring so-called “wet” signatures ...

Read More

The California Assembly Appropriations Committee unanimously passed a bill that would allow electronic signatures in proceedings before the Workers’ Compensation Appeals Board.

The committee on Wednesday voted 14-0 to pass bills on its consent file, which included Assembly Bill 2337, by Assemblymember Diane Dixon, R-Newport Beach. An analysis prepared for the committee projects that the costs of authorizing electronic signatures would be negligible.

The WCAB allowed electronic signatures during the COVID-19 pandemic but reverted to requiring so-called “wet” signatures ...

Read More

CA - WCIRB Submits Pure Premium Filing

04/26/2024 |

0

![]() The Workers’ Compensation Insurance Rating Bureau on Thursday said it submitted its annual advisory pure premium rate filing to the California Department of Insurance.

The WCIRB is recommending that the department increase the advisory pure premium rate by 0.9%. The average proposed advisory rate for policies incepting on or after Sept. 1 is $1.42 per $100 of payroll, up from $1.41.

The WCIRB said there are three key drivers of the increase.

“First, a higher medical severity trend was selected based on consideration of short-term trends, long-term trends and a recent shift ...

Read More

The Workers’ Compensation Insurance Rating Bureau on Thursday said it submitted its annual advisory pure premium rate filing to the California Department of Insurance.

The WCIRB is recommending that the department increase the advisory pure premium rate by 0.9%. The average proposed advisory rate for policies incepting on or after Sept. 1 is $1.42 per $100 of payroll, up from $1.41.

The WCIRB said there are three key drivers of the increase.

“First, a higher medical severity trend was selected based on consideration of short-term trends, long-term trends and a recent shift ...

Read More

LA - House Passes Bill Limiting Ability of Carriers to Recover Payments for Misclassified Workers

04/26/2024 |

0

![]() Louisiana lawmakers passed a bill that would require workers’ compensation carriers to provide written notice by certified mail if they want to collect additional payments from employers that paid less for coverage than they should have because they misclassified their workers.

The state House of Representatives voted 76-19 on Wednesday to pass HB 200, by Rep. Michael Melerine, R-Shreveport.

The bill would prohibit recovery of past work comp premiums if a carrier fails to send written notice to the employer by certified mail within 90 days of discovering the misclassification. Carr...

Read More

Louisiana lawmakers passed a bill that would require workers’ compensation carriers to provide written notice by certified mail if they want to collect additional payments from employers that paid less for coverage than they should have because they misclassified their workers.

The state House of Representatives voted 76-19 on Wednesday to pass HB 200, by Rep. Michael Melerine, R-Shreveport.

The bill would prohibit recovery of past work comp premiums if a carrier fails to send written notice to the employer by certified mail within 90 days of discovering the misclassification. Carr...

Read More

Sponsored Content

Press - Centre for Neuro Skills Promotes Nicholas Ashley to Chief Governance Officer

03/13/2024 |

0

Centre for Neuro Skills Promotes Nicholas Ashley to Chief Governance Officer

Bakersfield, Calif. (March 13, 2024) - Centre for Neuro Skills (CNS), a leader in traumatic brain injury and stroke rehabilitation services, today announced the promotion of Nicholas Ashley, J.D., M.D.R., to chief governance officer.

�Nick has been instrumental to the growth and expansion of CNS,� says David Harrington, president and chief executive officer of Centre for Neuro Skills. �I�m excited to continue working closely with him to advance patient care.�

During his 11-year tenure at CNS, Ashley serve...

Read More

Post Your Press Release Here!

NE - Governor Appoints Judge to Comp Court

04/26/2024 |

0

![]() Nebraska Gov. Jim Pillen on Thursday announced the appointment of Brynne Holsten Puhl to the Workers’ Compensation Court.

Puhl has been an attorney with Atwood Law litigating comp cases in Nebraska and Iowa since 2015, the governor’s office said in a statement.

Before that, she was an associate attorney at Engles, Ketcham, Olson and Keith Law and also handled work comp cases.

Puhl earned her bachelor’s degree and her law degree from the University of Nebraska.

She is filling a vacancy created by the retirement of James R. Coe, who stepped down on April 15 after s...

Read More

Nebraska Gov. Jim Pillen on Thursday announced the appointment of Brynne Holsten Puhl to the Workers’ Compensation Court.

Puhl has been an attorney with Atwood Law litigating comp cases in Nebraska and Iowa since 2015, the governor’s office said in a statement.

Before that, she was an associate attorney at Engles, Ketcham, Olson and Keith Law and also handled work comp cases.

Puhl earned her bachelor’s degree and her law degree from the University of Nebraska.

She is filling a vacancy created by the retirement of James R. Coe, who stepped down on April 15 after s...

Read More

CA - Worker Gets Benefits for Crash Despite Leaving Job Site Without Employer's Approval

04/25/2024 |

0

![]() A California appellate court upheld an award of benefits to a worker for his injuries from a car accident that happened after he left a fire camp without his employer’s knowledge and in violation of its rules, and used marijuana.

Braden Nanez worked for 3 Stonedeggs Inc., a mobile food service that contracts with the U.S. Forest Service to provide meals for firefighters and supporting personnel.

Nanez began working for the company in September 2020 at the age of 19. He was stationed at a fire camp in Brownsville and elected to stay on-site to get as many work hours as possible.

O...

Read More

A California appellate court upheld an award of benefits to a worker for his injuries from a car accident that happened after he left a fire camp without his employer’s knowledge and in violation of its rules, and used marijuana.

Braden Nanez worked for 3 Stonedeggs Inc., a mobile food service that contracts with the U.S. Forest Service to provide meals for firefighters and supporting personnel.

Nanez began working for the company in September 2020 at the age of 19. He was stationed at a fire camp in Brownsville and elected to stay on-site to get as many work hours as possible.

O...

Read More

NY - Court Revives Labor Law Claim of Worker Who Fell Into Manhole

04/25/2024 |

0

![]() A New York appellate court revived a worker’s Labor Law claim for injuries from falling into a manhole.

Case: Clarke v. Consolidated Edison of New York Inc., No. 158033/18, 04/18/2024, published.

Facts: Stephen Clarke suffered injuries when he fell into a manhole while he was working for his employer, which had contracted with Consolidated Edison of New York Inc. to perform underground inspections and repairs of network distribution equipment.

Procedural history: Clarke filed suit against Con Ed, asserting a claim for violations of the Labor Law.

Con Ed moved for summary judgmen...

Read More

A New York appellate court revived a worker’s Labor Law claim for injuries from falling into a manhole.

Case: Clarke v. Consolidated Edison of New York Inc., No. 158033/18, 04/18/2024, published.

Facts: Stephen Clarke suffered injuries when he fell into a manhole while he was working for his employer, which had contracted with Consolidated Edison of New York Inc. to perform underground inspections and repairs of network distribution equipment.

Procedural history: Clarke filed suit against Con Ed, asserting a claim for violations of the Labor Law.

Con Ed moved for summary judgmen...

Read More

CT - Notice of Intent to Contest Claim Must Be Delivered Within 28-Day Window

04/25/2024 |

0

![]() The Connecticut Supreme Court upheld a finding that an employer was precluded from contesting a worker’s claims for injury because the company did not timely file a notice of intent to do so.

Case: Ajdini v. Frank Lill & Son Inc., No. SC 20836, 04/23/2024, published.

Facts and procedural history: Ajredin Ajdini worked for Frank Lill & Son Inc. He allegedly sustained two injuries at work in July 2018. Ajdini filed separate claim forms that were received by the Workers’ Compensation Commission and FL&S on May 3, 2019.

FL&S mailed to the commission and Ajdini n...

Read More

The Connecticut Supreme Court upheld a finding that an employer was precluded from contesting a worker’s claims for injury because the company did not timely file a notice of intent to do so.

Case: Ajdini v. Frank Lill & Son Inc., No. SC 20836, 04/23/2024, published.

Facts and procedural history: Ajredin Ajdini worked for Frank Lill & Son Inc. He allegedly sustained two injuries at work in July 2018. Ajdini filed separate claim forms that were received by the Workers’ Compensation Commission and FL&S on May 3, 2019.

FL&S mailed to the commission and Ajdini n...

Read More

WV - Split Supreme Court Addresses Standard of Review, Burden of Proof for Apportionment

04/25/2024 |

0

![]() A divided West Virginia Supreme Court produced four opinions addressing an employer’s entitlement to apportion a worker’s impairment, with a majority clarifying the appropriate standard of review of a board decision and then concluding that the employer failed to carry its burden of proof on apportionment.

Case: Duff v. Kanawha County Commission, No. 23-43, 04/22/2024, published.

Facts: David Duff II worked for Kanawha County as a deputy sheriff. He injured his back in June 202 while lifting a bomb detector robot.

A claims adjuster for the county’s insurance carrier accept...

Read More

A divided West Virginia Supreme Court produced four opinions addressing an employer’s entitlement to apportion a worker’s impairment, with a majority clarifying the appropriate standard of review of a board decision and then concluding that the employer failed to carry its burden of proof on apportionment.

Case: Duff v. Kanawha County Commission, No. 23-43, 04/22/2024, published.

Facts: David Duff II worked for Kanawha County as a deputy sheriff. He injured his back in June 202 while lifting a bomb detector robot.

A claims adjuster for the county’s insurance carrier accept...

Read More

CA - Newsom Says Indoor Heat Safety Rules Too Expensive for Prisons

04/25/2024 |

0

![]() Correctional officers and other workers are likely to be left out of the new indoor heat standards California workplace safety regulators are reportedly scrambling to implement before summer starts after a last-minute objection from the governor's office over the cost of bringing prisons into compliance derailed the rulemaking process.

The California Division of Occupational Safety and Health in May 2023 started the formal process to adopt heat standards for indoor workplaces that have been in the works since 2016, according to reports by PBS and CalMatters.

California has had heat stand...

Read More

Correctional officers and other workers are likely to be left out of the new indoor heat standards California workplace safety regulators are reportedly scrambling to implement before summer starts after a last-minute objection from the governor's office over the cost of bringing prisons into compliance derailed the rulemaking process.

The California Division of Occupational Safety and Health in May 2023 started the formal process to adopt heat standards for indoor workplaces that have been in the works since 2016, according to reports by PBS and CalMatters.

California has had heat stand...

Read More

FL - Contractors Cited After Worker's Crane Death

FL - Contractors Cited After Worker's Crane Death

04/25/2024 |

0

![]() The U.S. Occupational Safety and Health Administration on Tuesday said it cited two Florida construction contractors over an October 2023 workplace death.

OSHA cited Tampa-based Concrete Impressions of Florida Inc. and Plant City-based Adcock Cranes, proposing penalties of $4,839 and $16,131, respectively, following the death of a worker who was struck by a boom as a crane tipped over during work on an Orlando highway ramp.

Employees of both companies were installing precast concrete sound barrier panels on the SR 417 ramp at the time of the incident.

A Concrete Impressions employee wa...

Read More

The U.S. Occupational Safety and Health Administration on Tuesday said it cited two Florida construction contractors over an October 2023 workplace death.

OSHA cited Tampa-based Concrete Impressions of Florida Inc. and Plant City-based Adcock Cranes, proposing penalties of $4,839 and $16,131, respectively, following the death of a worker who was struck by a boom as a crane tipped over during work on an Orlando highway ramp.

Employees of both companies were installing precast concrete sound barrier panels on the SR 417 ramp at the time of the incident.

A Concrete Impressions employee wa...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More

LOS ANGELES, April 22, 2024 - Sullivan on Comp, the leading comprehensive digital resource on California workers' compensation law, proudly announces the launch of ChatSOC, an advanced chatbot designed to streamline workers' compensation inquiries for professionals in the field. Officially launching today, ChatSOC integrates directly with the Sullivan on Comp digital treatise, provid...

Read More