Industry Insights

August 13, 2025

Paduda: California Comp Drivers, Part 2

- State: California

- - 0 shares

California’s a fifth of U.S. workers’ comp benefits, and medical expenses are on the rise.

Joe Paduda

Why?

Monday, we learned that unlisted codes, especially in physical medicine, are a big contributor. Today, we’re all about the fee schedule.

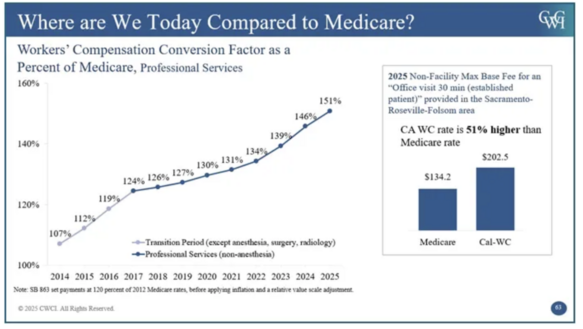

California’s Official Medical Fee Schedule for providers (physicians, PTs, etc.), aka the OMFS, is, like many states’ fee schedules, based on Medicare.

And like some other states, California’s Division of Workers' Compensation finagles Medicare’s fee schedule, specifically by updating the conversion factor every year. Briefly, DWC applies the annual percentage change in the Medicare Economic Index. The MEI factors in cost changes for stuff providers need — workers, materials, space, etc. So, as those costs increase, so does the OMFS.

DWC can also change the OMFS if the Centers for Medicare and Medicaid makes temporary adjustments, as it did during COVID.

OK, which means what?

So glad you asked:

Thanks to the California Workers' Compensation Institute for the graphic.

What does this mean for you?

DWC’s use of the MEI has increased provider fees faster and is higher than Medicare’s reimbursement.

While medical inflation in California work comp has been significant, two of the three drivers are specific to California.

One more to come.

Note: The brilliant explainers at CWCI published an excellent report on this issue last year. It’s available here.

Joseph Paduda is the principal of Health Strategy Associates, a consulting firm focused on improving medical management programs in workers’ compensation. This column is republished with his permission from his Managed Care Matters blog.

Advertisements

Columns

- Kamin: Subpoenaed Records That Can Help With Internal, Psych Claims 08/27/25

- Peabody: Request for Remote Testimony Can Satisfy WCAB Rules With Due Process at Stake 08/25/25

- Montgomery: New DOL Billing Requirements 08/22/25

- CAAA: State Extends Safety Protections to Domestic Service Workers 08/20/25

- Zachry: A Leader in the Fight Against Opioid Abuse 08/18/25

- Kamin: Asking About Liens Against Compensation 08/15/25

- Snyder: Examine Your Process 08/14/25

- Paduda: California Comp Drivers, Part 2 08/13/25

- CAAA: DWC Fumbles UR Rulemaking 08/12/25

- Paduda: California Comp Drivers, Part 1 08/11/25

- Langham: Bias Is Pernicious 08/08/25

- CAAA: Workers Can't Wait for Heat Protection 08/06/25

- Montgomery: State's Mandatory E-Billing Process Arrives 08/04/25

- CAAA: Audit Exposes Deep Failures at Cal/OSHA 07/30/25

- Paduda: Work Comp Remains the Darling of P&C Industry 07/28/25

- Wroten: The Flip Side of Regulations 07/25/25

- Moore: Were We Right About Comp in 2022? 07/23/25

- Kamin: WCIRB Says Carriers Losing Money Due to Rising Costs 07/21/25

- Paduda: What's Happening in Golden State Work Comp? 07/18/25

- CAAA: Fireworks Warehouse Blast Exposes Flaws in Safety, Oversight, Accountability 07/16/25

Now Trending

- Workers' Compensation News

-

Calif. Assembly

Passes Comp…

Posted on Sep 2, 2025

-

Calif. Amendment

Would Limit Expansion of Heart

Trouble…

Posted on Aug 28, 2025

-

Wash. Report:

Computer System Upgrade Suspended

for Lack of…

Posted on Aug 28, 2025

-

Calif. DWC

Proposes MTUS…

Posted on Aug 26, 2025

-

Calif. Senate

Passes Bill to Extend SCIF

Investment…

Posted on Aug 27, 2025

-

Minn. Report Finds

High Denial Rate for Presumptive

PTSD…

Posted on Aug 29, 2025

-

Pa. Superior Court

Upholds $7.3 Million Jury Verdict

for Worker Struck by…

Posted on Aug 26, 2025

-

Ohio Supreme Court

Reinstates Denial of Worker's

Request for PTD…

Posted on Aug 28, 2025

-

Ntl. NCCI: CMS

Price Changes Not Significant Cost…

Posted on Aug 29, 2025

-

Ky. Court Affirms

Finding That Farm Not Liable for

Endemic Fungal…

Posted on Aug 26, 2025

Jobs

Upcoming Events

Sep 2-4, 2025

San Diego Elevate Workers' Com

We are thrilled to announce that Early Bird registration is OPEN for ELEVATE® 2025! This year's …

Nov 7, 2025

WIMAH 2025 Workers’ Compensati

Join Hawai'i’s premier workers’ comp event for expert insights, top-tier networking, and standout …

Social Media Links

c/o Business Insurance Holdings, Inc.

Greenwich, CT 06836

No Comments

Log in to post a comment